Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 20 August 2020 01:42 - - {{hitsCtrl.values.hits}}

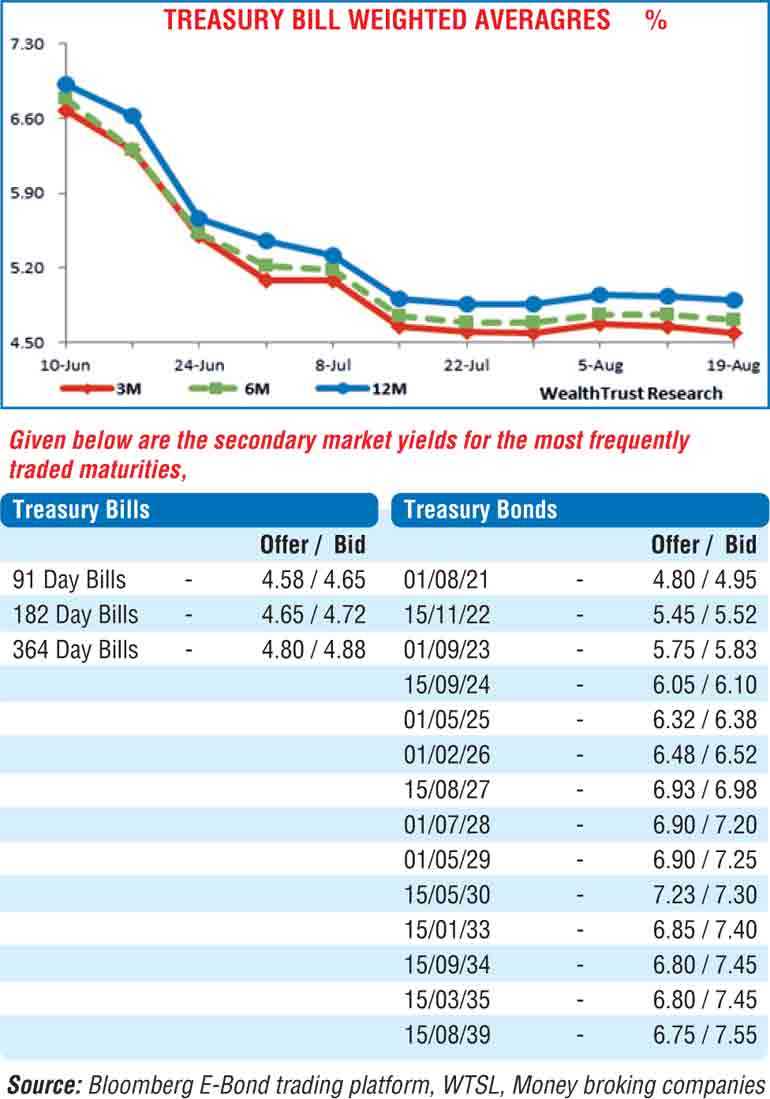

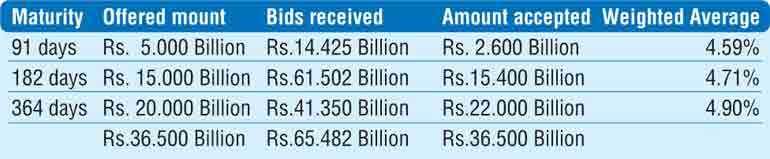

The weekly Treasury bill auction saw its weighted averages dip across all three maturities as its total offered amount of Rs 40 billion was fully subscribed. The 91 day bill slipped the most, declining by 6 basis points to 4.59% followed by the 182 day and 364 days bills by 5 and 3 basis points respectively to 4.71% and 4.90%. The bids to offer ratio was seen increasing to a five week high of 2.93:1.

Meanwhile, secondary market bonds were seen changing hands within a narrow yield range yesterday with activity centring on the liquid maturities. The liquid maturities of 2022s (i.e. 15.11.22 & 15.12.22), 15.01.23, 15.09.24, 01.05.25, 01.02.26 and 2027s (15.08.27 & 15.10.27) were exchanged within the levels of 5.50%, 5.47% to 5.52%, 5.48% to 5.51%, 6.05% to 6.10%, 6.31%, 6.48% to 6.52, 6.93% to 6.95% and 7.00% respectively. However, activity came to a halt towards the latter part of the day due to a wait and see policy by most participants ahead of today’s monetary policy announcement due at 7.30 am. The Central Bank of Sri Lanka was seen cutting policy rates by 100 basis points and its previous announcement on 9 July.

In secondary bills, November 2020, January and July 2021 maturities were seen changing hands at levels of 4.60%, 4.67% to 4.69% and 4.81% to 4.85% respectively.

The total secondary market Treasury bond/bill transacted volumes for 18 August was Rs. 11.55 billion. The high surplus liquidity of Rs. 195.67 billion saw overnight call money and repo average steadily at 4.53% and 4.55% respectively yesterday in the money market.

LKR dips close to Rs. 186

The continued buying interest by banks led to the USD/LKR rate on spot contracts recording a sharp decline to close the day at Rs. 185.90/20 against its previous day’s closings of Rs. 184.30/50.

The total USD/LKR traded volume for 18 August was $ 56.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)