Monday Feb 09, 2026

Monday Feb 09, 2026

Thursday, 29 August 2019 00:44 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

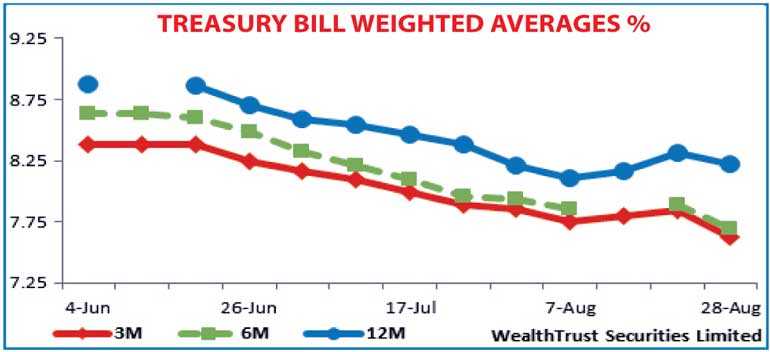

The weekly Treasury bill auction conducted yesterday saw its weighted averages decreasing from its previously recorded weighted averages for the first time in three weeks, following the policy easing of 50 basis points. The 91 day bill recorded the sharpest dip of 21 basis points to 7.63% closely followed by the 182 day bill by 19 basis points to 7.70% and the 364 day bill by 09 basis points to 8.22%. The total offered amount of Rs. 12.5 billion was successfully met at the auction as the total bids received to total offer ratio was seen increasing to a five week high of 2.96:1.

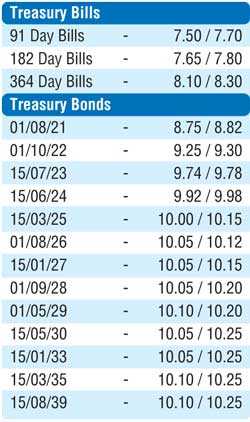

In the secondary bond market, activity continued at a moderate pace yesterday with yields increasing further for a third consecutive day. The yields on the most sorted maturities of 15.03.24 and 15.06.24 were seen hitting intraday highs of 9.95% each against their previous day’s closing levels of 9.86/92 and 9.88/95. In addition, 01.08.21, the two 2022’s (i.e. 01.07.22 & 01.10.22), 15.07.23 and 01.06.26 maturities changed hands at levels of 8.78%, 9.15% to 9.20%, 9.25% to 9.28%, 9.75% and 10.10% to 10.15% respectively as well. In the secondary bill market, February 2019 maturities were traded at levels of 7.70% to 7.78%. The total secondary market Treasury bond/bill transacted volumes for 27 August was Rs. 4.48 billion.

In money markets, the overnight net liquidity surplus in the system was seen reducing further to over an four month low of Rs. 2.02 billion yesterday as the overnight call money and repo rates increased marginally to average at 7.32% and 7.40% respectively. The OMO (Open Market Operations) Department of the Central Bank of Sri Lanka refrained from conducting any auctions yesterday for a third consecutive day.

Rupee loses further

In the Forex market, the USD/LKR rate on spot contracts were seen decreasing further yesterday to close the day at Rs. 180.20/60 against its previous day’s closing levels of Rs. 179.75/85 on the back of importer demand and buying interest by Banks.

The total USD/LKR traded volume for 27 August was $ 66.10 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 181.00/10; 3 months - 182.00/20 and 6 months - 183.35/65.