Friday Feb 13, 2026

Friday Feb 13, 2026

Thursday, 28 December 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

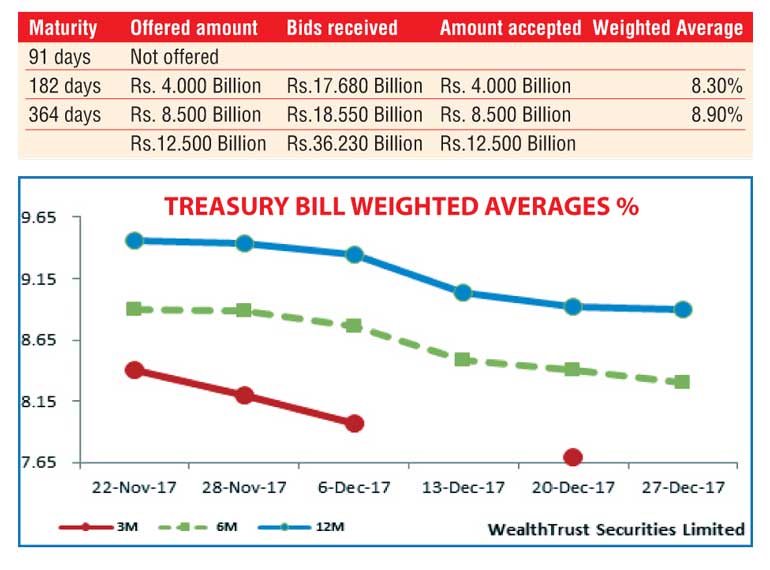

The degree of declines in the weighted averages at the weekly Treasury bill auction was seen slowing for a second consecutive week yesterday, recording its sixth consecutive week of declines.

The 182-day bill registered a drop of 10 basis points to 8.30%, while the 364 day dipped by a meager 02 basis points to 8.90%. The 52 week low, total offered amount of Rs. 12.5 billion was fully met at the auction as the bid to offer ratio stood at 2.90:1.

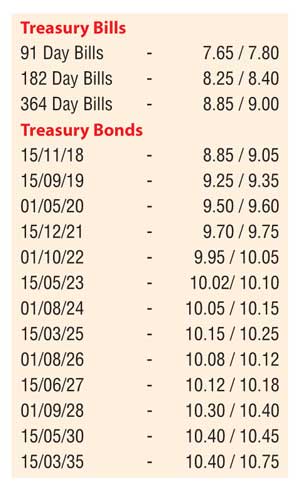

This was ahead of the year’s final Treasury bond auctions, to the tune of Rs. 30 billion, which will consist of Rs. 8 billion on a 2.11 year maturity of 15.12.2020 and Rs. 22 billion on an 8.05 year maturity of 01.06.2026. The previous Treasury bond auctions conducted on 29 November for the maturities of 15.05.23 and 15.06.27 recorded weighted averages of 10.20% and 10.36% respectively.

In the secondary bond market yesterday, yields were seen increasing towards the latter part of the day, mainly on the 01.08.26 and 15.06.27 maturities to intraday highs of 10.15% and 10.18% respectively against its opening lows of 10.05% and 10.15%, amid moderate volumes.

The eighth and last monetary policy announcement for 2017 is due today at 7.30 a.m. The Central Bank of Sri Lanka last changed its policy rates with an increase of 25 basis points at its meeting held in March 2017.

The total secondary market Treasury bond/bill transacted volumes for 26 December 2017 was Rs. 2.27 billion.

In the money market, overnight call money and repo rates remained mostly unchanged to average 8.15% and 7.50% respectively as the OMO Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 12 billion at a weighted average of 7.25%, by way of an overnight repo auction. The net liquidity surplus in the system stood at Rs. 17.74 billion with a further amount of Rs. 10.35 billion being deposited at CBSL’s Standing Deposit Facility Rate of 7.25% against a borrowing amount of Rs. 4.60 billion at its Standing Lending Facility Rate of 8.75%.

The Central Bank of Sri Lanka’s (CBSL) Treasury bill holding was seen increasing considerably to over a three-month high of Rs.90.07 billion in book value terms yesterday against its previous day’s figure of Rs. 10.07 billion.

Rupee

appreciates further

The USD/LKR rate on spot contracts was seen appreciating for a fifth consecutive day to close the day at Rs. 152.40/55 against its previous day’s closing levels of Rs. 152.70/75, on the back of continued exporter dollar conversions and inward remittances.

The total USD/LKR traded volume for 26 December 2017 was $ 69.50 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 153.55/65;

three months - 155.30/45 and six months - 157.90/10.