Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 5 November 2020 00:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

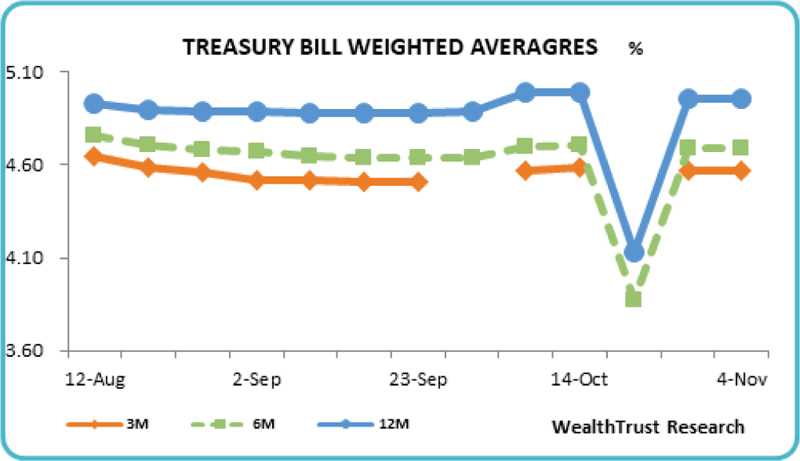

The weighted average rates at the weekly Treasury bill auctions conducted yesterday were recorded at its stipulated cut off rates while the auction was undersubscribed for a second consecutive week.

The weighted average rates at the weekly Treasury bill auctions conducted yesterday were recorded at its stipulated cut off rates while the auction was undersubscribed for a second consecutive week.

The auction registered a shortfall of Rs. 20.99 billion against its total offered amount of Rs. 40 billion while its bids to offer ratio decreased to a four weeks low of 1.31:1. The weighted average rates of the 91 day, 182 day and 364 maturities were registered at 4.57%, 4.69% and 4.96% respectively.

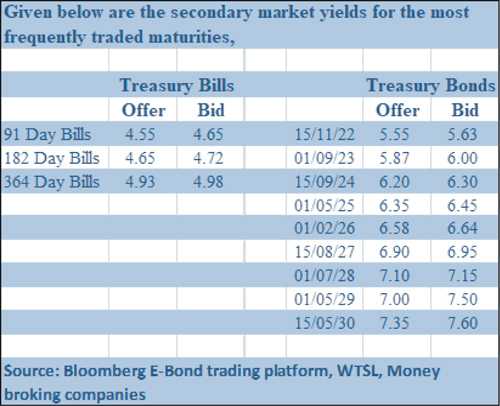

In the secondary bond market, yields increased further on the back of moderate activity. Limited trades of the 15.07.23, 01.08.24, 15.09.24 and 01.07.28 were witnessed at levels of 5.87% to 5.90%, 6.30% to 6.35%, 6.20% and 7.15% respectively against its previous day’s closing levels of 5.75/90, 6.22/25, 6.16/20 and 7.10/15.

In addition, the 01.05.28 maturity traded at levels of 7.16% to 7.18% while in the secondary bill market, April 2021 maturities continued to changed hands at levels of 4.65% to 4.70%.

In the money market, the weighted average rates on overnight call money and repo remained mostly unchanged at 4.53% and 4.59% respectively as the overnight net surplus liquidity increased marginally to Rs.141.32 billion yesterday.

Rupee steady

The USD/LKR rate on spot contracts was seen closing the day steady at Rs. 184.35/45 yesterday on the back of an equilibrium market.

The total USD/LKR traded volume for 3 November was $ 95.75 million. (References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)