Sunday Mar 16, 2025

Sunday Mar 16, 2025

Thursday, 2 March 2023 01:49 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

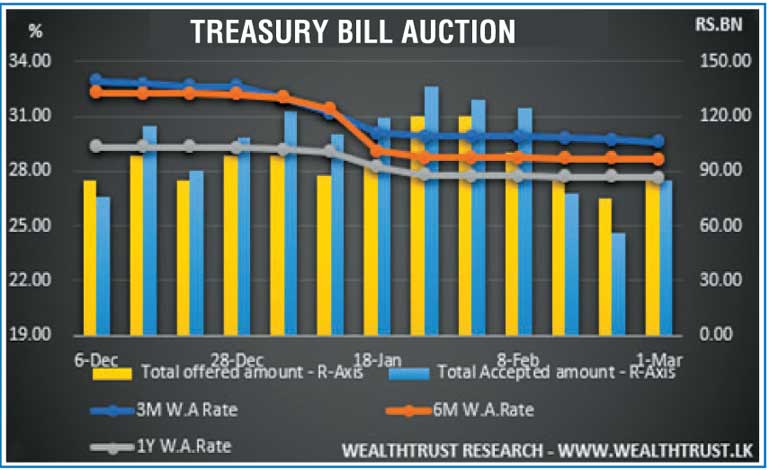

The weekly Treasury bill auction saw its total offered amount fully subscribed for the first time in 3-weeks yesterday as its bids to offer ratio increased to a 3-week high of 1.97:1 as well. The exact offered amount on each maturity was accepted as weighted averages decreased across the board.

The weekly Treasury bill auction saw its total offered amount fully subscribed for the first time in 3-weeks yesterday as its bids to offer ratio increased to a 3-week high of 1.97:1 as well. The exact offered amount on each maturity was accepted as weighted averages decreased across the board.

The 91-day dipped by 13 basis points to 29.59% while the 182-day and 364-day maturities decreased by 03 basis points to 28.64% and 27.64% respectively.

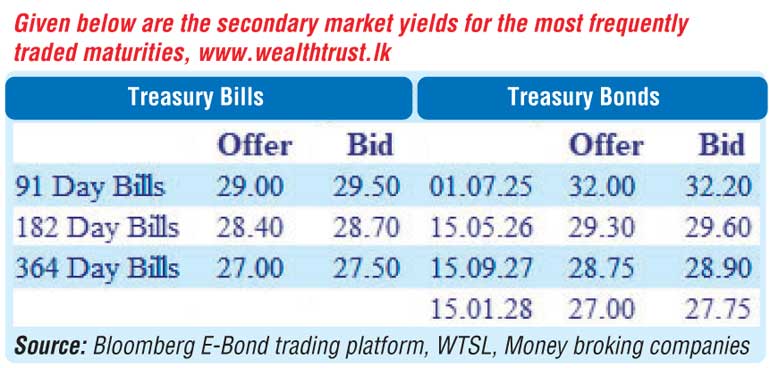

The activity levels in the secondary bond market picked up once again yesterday as buying interest saw yields dip. Activity centred on the maturities of 2025’s (i.e., 15.01.25 & 01.07.25) and 15.09.27 as it was seen changing hands at levels of 32.00% to 32.20% and 28.75% to 29.05% respectively. In addition, maturities of 01.05.24, 15.05.26 and 15.01.28 changed hands at 31.80%, 29.60% to 29.65% and 28.00% respectively as well. In secondary bills, the latest 91-day bill maturity traded at a low of 29.00% following the auction outcome.

In money markets, the net liquidity deficit stood at Rs. 129.44 billion yesterday as an amount of Rs. 7.98 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50% against an amount of Rs. 137.42 billion being withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 15.50%. The weighted average rates on overnight call money and REPO stood at 15.47% and 15.50% respectively.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated to Rs. 358.4593 against its previous days of Rs. 361.6318 while cash and spot contracts were traded within the range of Rs. 353.00 to Rs. 355.00.

The total USD/LKR traded volume for 28 February was $ 96.39 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.