Friday Mar 14, 2025

Friday Mar 14, 2025

Thursday, 8 July 2021 00:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

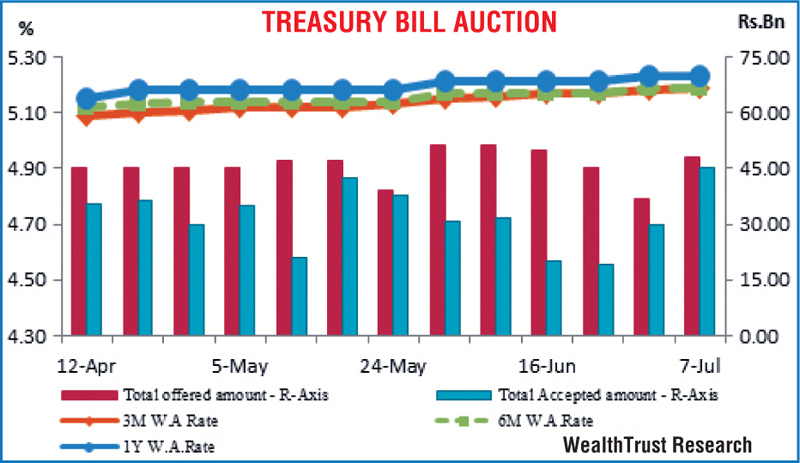

The total accepted amount at yesterday’s Treasury bill auction was seen increasing for a third consecutive week to 93.63% of its total offered amount as an amount of Rs. 42.08 billion alone was accepted on the 91-day maturity against its offered amount of Rs. 15 billion.

The total accepted amount at yesterday’s Treasury bill auction was seen increasing for a third consecutive week to 93.63% of its total offered amount as an amount of Rs. 42.08 billion alone was accepted on the 91-day maturity against its offered amount of Rs. 15 billion.

The weighted average rate on the 91-day bill maturity recorded a one basis point increase to 5.19%, while the weighted average rate on the 182-day maturity remained unchanged at 5.19%. The weighted average rate on the 364-day maturity was recorded at its stipulated cut-off rates of 5.23%.

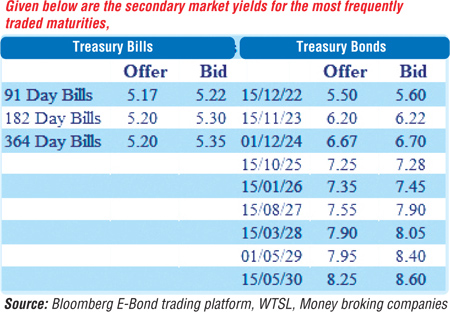

The activity in the secondary bond market remained moderated yesterday with most market participants opting to be on the sidelines. Limited trades were seen on the maturities of 2023’s (i.e. 15.03.23, 01.09.23 and 15.11.23) and 2024’s (i.e. 15.03.24 and 01.12.24) at levels of 5.85%, 6.05% to 6.08%, 6.20%, 6.40% and 6.70%, respectively.

This was ahead of today’s monetary policy announcement due at 7:30 a.m., the fifth for 2021. The Monetary Board of the Central Bank of Sri Lanka, at its last announcement made on 20th of May 2021 kept its policy rates of Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) steady at 4.50% and 5.50% respectively for a seventh consecutive announcement.

The total secondary market Treasury bond/bill transacted volume for 6 July was Rs. 3.03 billion.

In money markets, the overnight net liquidity surplus was seen increasing yesterday to Rs. 91.50 billion as an amount of Rs. 153.70 billion was deposited at Central Banks SLDR of 4.50% against its previous days Rs. 149.39 billion. An amount of Rs. 62.20 billion was withdrawn from Central Banks SLFR of 5.50% against its previous days of Rs. 64.60 billion. The weighted average rates on overnight call money and repo were registered at 4.93% and 4.97%, respectively.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday. The total USD/LKR traded volume for 6 July was $ 88.20 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.