Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 30 July 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

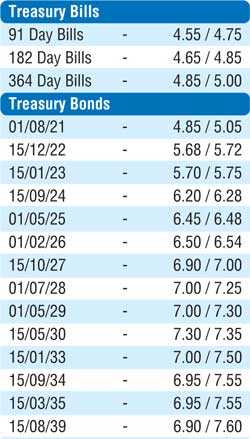

The total accepted amount at yesterday’s primary bill auction fell short of the total offered amount, for the first time in seven weeks, with only an amount of Rs. 11.9 billion being accepted against a total  offered amount of Rs. 39.5 billion. The bids to offer ratio too dipped to a low of 1.19:1 for the first time since 17 December 2018. However, the weighted average yields of the 91 and 182 day maturities decreased by 01 basis point each to 4.59% and 4.68% respectively with the 364 day bill remaining steady at 4.86%.

offered amount of Rs. 39.5 billion. The bids to offer ratio too dipped to a low of 1.19:1 for the first time since 17 December 2018. However, the weighted average yields of the 91 and 182 day maturities decreased by 01 basis point each to 4.59% and 4.68% respectively with the 364 day bill remaining steady at 4.86%.

This was ahead of today’s Treasury bond auction in lieu of the 01.08.20 maturity of Rs. 71.5 billion. A total amount of Rs. 110 billion will be on offer, consisting of Rs. 45 billion of a new 2 year and 3 month maturity of 15.11.2022, Rs. 35 billion of a 5 year and 06 month maturity of 01.02.2026 and a further Rs. 30 billion of a 7 year maturity of 15.08.2027. Stipulated cut off rates were published as 5.75%, 6.52% and 7.08% respectively. The weighted average yields at the bond auctions conducted on 13 July for the maturities of 15.12.2022 and 01.02.2026 were recorded at 5.47% and 6.57% respectively.

In the secondary bond market, activity continued at a moderate pace with trades taking place within a tight range. The maturities of 15.12.22, 2023s (i.e. 15.01.23, 15.03.23, 15.05.23, 15.07.23 & 01.09.23), 2024s (i.e. 01.01.24 & 15.06.24), 01.05.25, 2026s (i.e. 01.02.26, 01.06.26 & 01.08.26) and 15.05.30 changed hands at levels of 5.70%, 5.70% to 5.75%, 5.80%, 5.90%, 5.95%, 5.95% to 6.00%, 6.10%, 6.20% to 6.25%, 6.45% to 6.48%, 6.52% to 6.53%, 6.65%, 6.67% and 7.29% to 7.33% respectively. In the secondary bill market, October 2020, November 2020, March 2021 and July 2021 maturities traded at levels of 4.70% to 4.75%, 4.72%, 4.85% and 4.95% to 5.00% respectively.

The total secondary market Treasury bond/bill transacted volumes for 28 July was Rs. 18.58 billion.

In money markets, the weighted average rate of overnight call money and repo’s recorded 4.53% and 4.57% respectively as the surplus liquidity in the system increased to Rs. 135.71 billion.

Rupee remains steady

The USD/LKR rate on spot contracts remained steady yesterday to close the day at Rs. 185.72/77 subsequent to trading within the range of Rs. 185.70 to Rs. 185.75.

The total USD/LKR traded volume for 28 July was $ 115.17 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)