Wednesday Feb 26, 2025

Wednesday Feb 26, 2025

Thursday, 28 December 2023 00:30 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

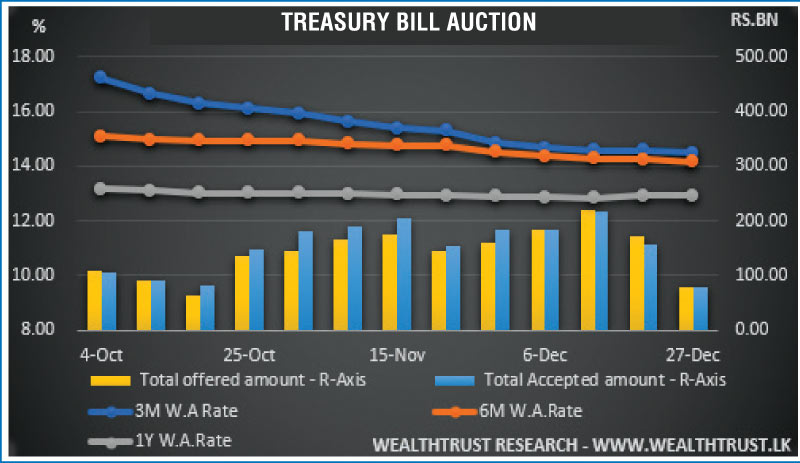

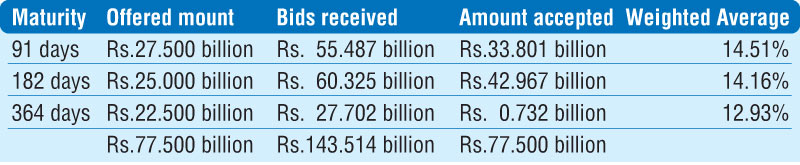

The weekly Treasury bill auction saw its total offered amount been fully taken up at its 1st phase of the auction for the first time in three weeks while weighted average rates decreased across the board. The 182-day bill deceased the most by 08 basis points to 14.16% while 91-day maturity registered a dip of 06 basis points to 14.51%. The weighted average rate on the 364-day bill remained steady at 12.93%.

The weekly Treasury bill auction saw its total offered amount been fully taken up at its 1st phase of the auction for the first time in three weeks while weighted average rates decreased across the board. The 182-day bill deceased the most by 08 basis points to 14.16% while 91-day maturity registered a dip of 06 basis points to 14.51%. The weighted average rate on the 364-day bill remained steady at 12.93%.

The phase 2 of the auction will be opened for the 91-day and 364-day maturities at its weighted average rates until close of business of the day prior to settlement (i.e. 4.00 p.m. on 28.12.2023).

Today’s bond auctions, conducted in lieu of a Treasury bond maturity of Rs.71.8 billion due on the 1 January, will see a total amount of Rs. 155 billion on offer consisting of Rs. 65 billion each on 01.02.2026 and 15.03.2028 maturities and a further Rs. 25 billion on a 15.05.2030 maturity.

At the auctions conducted on 12 December, only Rs. 156 billion was accepted in total against a total offered amount of Rs. 160 billion. However, the offered amount of Rs. 50 billion on the 01.08.2026 and Rs. 80 billion on the 15.12.28 maturities were was fully subscribed at the auction while an additional Rs. 26 billion which was offered through its direct issuance window was fully taken as well. The weighted average rates were stood at 14.07% and 14.32% respectively. The all bids received on the 15.03.2031 maturity was rejected.

The activity in the secondary bond market was at a standstill yesterday as majority of market participants opted to be on the side-lines. Limited trades were reported on the 2025’s (i.e. 15.01.25 & 01.07.25) and 15.01.27 maturities at levels of 13.40% to 13.60% and 13.80% respectively. In the secondary bill market, 7 June 2024 bill was seen changing hands at a low of 14.10%.

The total secondary market Treasury bond/bill transacted volume for 22 December was Rs. 6.74 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.12% and 10.00% respectively while the net liquidity stood at a deficit of Rs. 105.53 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 74.75 billion at the weighted average rates of 9.10%. An amount of Rs. 1.72 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 10.00% while an amount of Rs. 32.50 billion was deposited at its SDFR (Standard Deposit Facility Rate) of 9.00%.

Forex Market

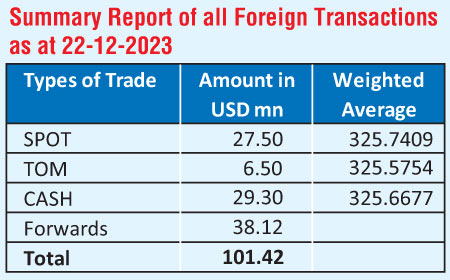

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs. 323.75 to Rs. 325.00 yesterday against its previous day’s closing of Rs. 325.25/325.50 and closed the day at Rs. 324.00/324.10.

The total USD/LKR traded volume for 22 December was $ 101.42 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.