Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 16 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

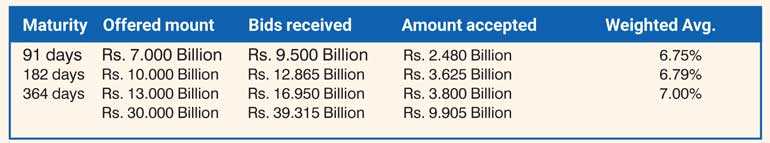

The commencement of a shortened trading week yesterday saw the weekly Treasury bill auctions record weighted averages broadly steady in comparison to its previous week’s averages. The market  favorite 364 – day bill logged in a weighted average of 7.00% for a second consecutive week while the 182 – day bill dipped by a single basis point to 6.79%. The 91 – day bill which was accepted after a lapse of one week, recorded a weighted average of 6.75%, registering a 5 basis point drop. However, the total accepted amount was seen falling short of the total offered amount for a fourth consecutive week.

favorite 364 – day bill logged in a weighted average of 7.00% for a second consecutive week while the 182 – day bill dipped by a single basis point to 6.79%. The 91 – day bill which was accepted after a lapse of one week, recorded a weighted average of 6.75%, registering a 5 basis point drop. However, the total accepted amount was seen falling short of the total offered amount for a fourth consecutive week.

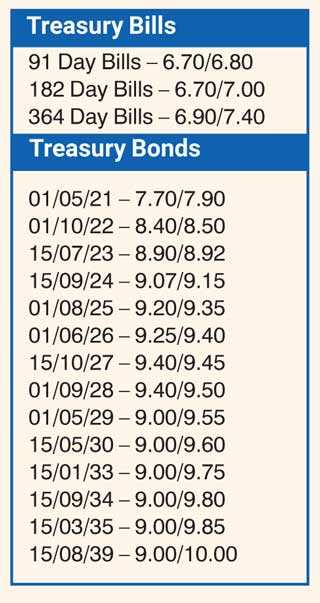

In the secondary bond market, yields increased marginally in moderate trades yesterday. The liquid maturities of 2023s (i.e. 15.07.23 & 01.09.23) and 2024’s (i.e. 15.03.24, 15.06.24 & 15.09.24) changed hands at levels of 8.98%, 8.95% to 9.00%, 9.05% to 9.12%, 9.10% to 9.12% and 9.10% respectively. In secondary bills, a March 2021 maturity was seen changing hands at 7.47%.

In money markets, the weighted average rate on overnight call money stood at 6.51% as the overnight net liquidity surplus stood at Rs. 40.46 billion. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 14 – day reverse repo auctions for volumes of Rs. 16.65 billion and Rs. 13.0 billion respectively at weighted averages of 6.50% and 6.60%, subsequent to offering Rs. 20 billion each. A further injection of Rs. 25 billion for 88 days drew no successful bids.

Rupee trades on spot contracts

In the Forex market, the USD/LKR rate on spot contracts was traded at Rs. 191.00 and Rs 192.00 yesterday.

The total USD/LKR traded volume for 9 April was $ 131.90 million.