Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 26 May 2022 00:51 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

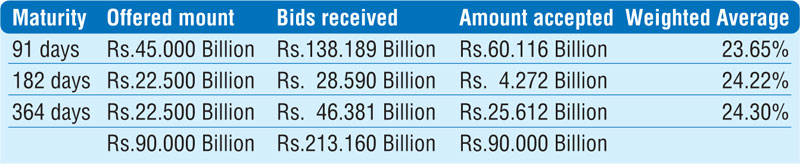

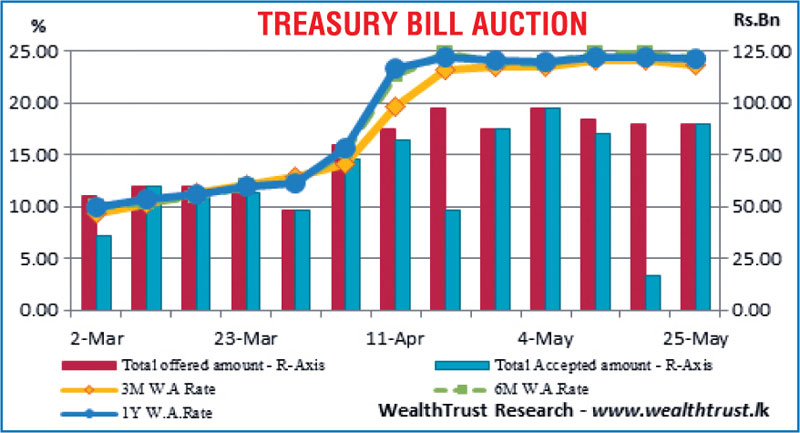

The weekly Treasury bill auction produced an impressive outcome, as weighted averages dipped on all three maturities while the auction was fully subscribed after a lapse of two weeks.

The market favourite 3 month bill maturity recorded a fall of 42 basis points to 23.65% while the 6 month and 1 year maturities dipped by 47 and 20 basis points respectively to 24.22% and 24.30%. The total offered amount of Rs. 90 billion was successfully accepted at the auction while its bids to offer ratio increased to a 15 week high of 2.36:1.

In the secondary bond market, limited activity continued on the liquid 01.06.25 maturity at levels of 22.63% to 22.665%. Nevertheless, renewed buying interest in secondary bills, post auction results, saw the latest 3 month, 6 month and 1 year maturities trading at lows of 22.00%, 23.50% and 23.75% respectively.

The total secondary market Treasury bond/bill transacted volume for 24 May was Rs. 6.8 billion.

In money markets, the weighted average rates on overnight Call money and REPO was registered at 14.50% each while the net liquidity deficit stood at Rs. 523.99 billion yesterday. An amount of Rs. 194.30 billion was deposited at Central Bank’s Standard Deposit Facility Rate (SDFR) of 13.50% while an amount of Rs. 718.29 billion was withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 14.50%.

Forex market

In the forex market, the middle USD/LKR spot contract rate remained steady at Rs. 359.3764 yesterday.

The total USD/LKR traded volume for 24 May was $ 10.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)