Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 9 September 2021 00:53 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

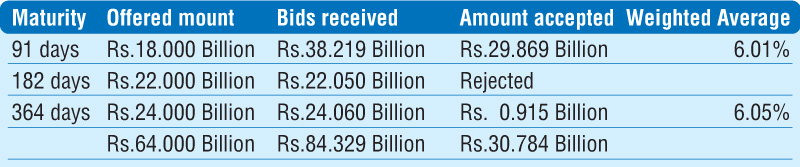

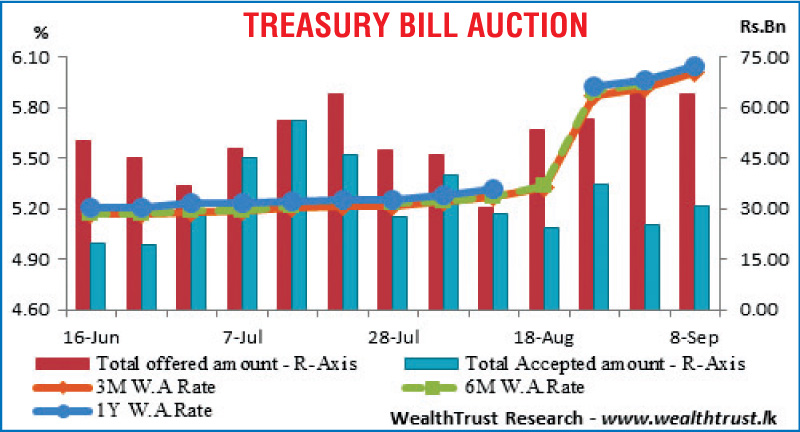

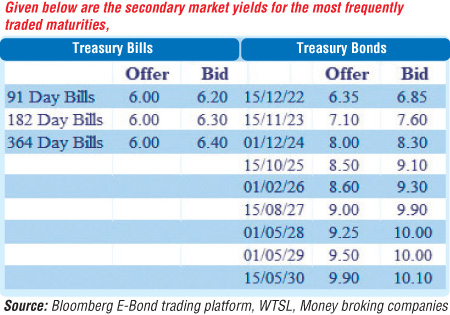

The weekly Treasury bill weighted average yields continued to increase at its auctions held yesterday, with the 91-day and 364-day maturities increasing above 6% for the first time since 17 June 2020. Both maturities recorded an increase of nine basis points each to 6.01% and 6.05% respectively, while all bids received on the 182-day maturity were rejected. However, the auction went undersubscribed for an eighth consecutive week as only 48.10%, or Rs. 30.78 billion, was accepted in total against a total offered amount of Rs. 64 billion. The bids to offer ratio decreased to 1.32:1. In the secondary bond market, limited trades were witnessed on the maturities of 15.01.26, 01.05.29 and 15.05.30 as it changed hands at levels of 9%, 9.98% to 10.23% and 9.98% to 10% respectively. In secondary bills, a 14 January 2022 bill changed hands at a level of 6.14%.

The weekly Treasury bill weighted average yields continued to increase at its auctions held yesterday, with the 91-day and 364-day maturities increasing above 6% for the first time since 17 June 2020. Both maturities recorded an increase of nine basis points each to 6.01% and 6.05% respectively, while all bids received on the 182-day maturity were rejected. However, the auction went undersubscribed for an eighth consecutive week as only 48.10%, or Rs. 30.78 billion, was accepted in total against a total offered amount of Rs. 64 billion. The bids to offer ratio decreased to 1.32:1. In the secondary bond market, limited trades were witnessed on the maturities of 15.01.26, 01.05.29 and 15.05.30 as it changed hands at levels of 9%, 9.98% to 10.23% and 9.98% to 10% respectively. In secondary bills, a 14 January 2022 bill changed hands at a level of 6.14%.

The total secondary market Treasury bond/bill transacted volume for 7 September was Rs. 0.95 billion.

In money markets, the weighted average rates on call money and repo remained steady at 5.95% and 5.87% respectively as an amount of Rs. 271.29 billion was withdrawn from the Central Bank’s SLFR of 6%. The net liquidity deficit increased further to Rs. 192.02 billion yesterday with an amount of Rs. 79.27 billion being deposited at the Central Bank’s SDFR of 5.00%.

USD/LKR

In the forex market, the overall market continued to remain inactive yesterday. The total USD/LKR traded volume for 7 September was $ 21 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)