Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 11 February 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weighted average rates at yesterday’s weekly Treasury bill auction were seen increasing on all three maturities, while the total accepted amount dipped to a 12-week low of Rs. 13.92 billion against its total offered amount of Rs. 40 billion.

The weighted average rates at yesterday’s weekly Treasury bill auction were seen increasing on all three maturities, while the total accepted amount dipped to a 12-week low of Rs. 13.92 billion against its total offered amount of Rs. 40 billion.

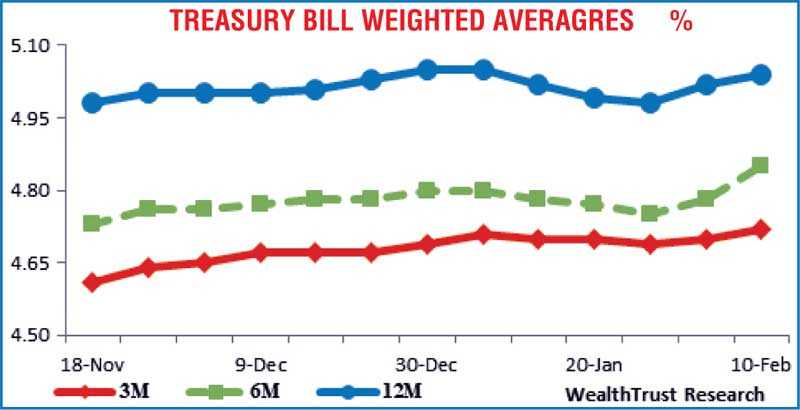

The 182-day bill increased the most by seven basis points to 4.85%, followed by the 91-day and 364-day bill by two basis points each to 4.72% and 5.04% respectively. The weighted average rate of the 364-day maturity was registered at 5.04%, below its stipulated cut-off rate of 5.05%, while no cut-off rates were announced on the 91-day and 182-day maturities this week. The total bids-to-offer ratio stood at 1.86:1. Given below are the details of the auction,

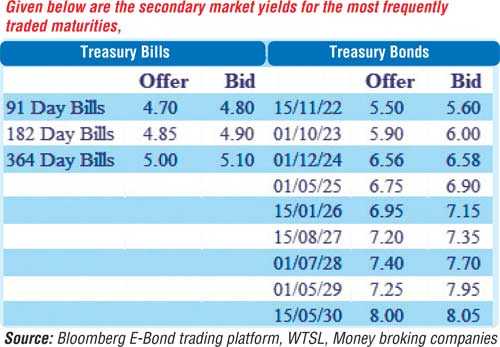

Meanwhile, activity in the secondary bond market moderated yesterday as most market participants opted to stay on the side-lines. Limited trades were witnessed on the 01.12.24 and 15.10.27 maturities at levels of 6.55% to 6.56% and 7.32% respectively. In the secondary bill market, 9 July maturity was seen changing hands at a level of 4.75%, pre-auction.

The total secondary market Treasury bond/bill transacted volumes for 9 February 2021 was Rs. 7.07 billion.

In the money market, weighted average rates on overnight call money and repo remained mostly unchanged at 4.55% each, while the net surplus liquidity was registered at Rs. 129.66 billion.

Rupee continues to slide

In Forex markets, USD/LKR rate on the more active one-week forward contracts were seen closing the day at Rs. 196.00/198.00 in comparison to its spot closing of Rs. 194.50/196.50 the previous day.

The total USD/LKR traded volume for 9 February was $ 62.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)