Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 4 January 2018 00:00 - - {{hitsCtrl.values.hits}}

Reuters: World stocks hit fresh highs on Wednesday with European markets joining the party as early indications suggest 2018 will be another year of synchronised global growth led by a shining European economy.

After its biggest one-day gain in more than two weeks on Tuesday, in the wake of its best year since 2009 in 2017, MSCI’s index of global stocks, which tracks shares in 47 countries, pushed on to new record highs.

The pan-European stock index opened 0.3% higher, adding to gains for their Asian and the United States counterparts overnight as manufacturing surveys pointed to a strong start for the European economy.

The single currency was holding near a four-month high of $ 1.2081 hit on Tuesday.

“Investors have woken up in the new year and looked forward to another firm year for global growth with very muted downside risk,” said Investec economist Philip Shaw, though he warned against reading too much into the first two trading days of the new year.

“The converse is the sell-off in bond markets: the idea that inflation pressures may be firmer than expected and central banks could take a slightly more aggressive approach than previously thought,” he said.

For example, ECB rate-setter Ewald Nowotny told a German newspaper that the European Central Bank may end its stimulus programme this year if the euro zone economy continues to grow strongly.

Borrowing costs across the euro area stayed near recent highs: the yield on Germany’s 10-year government bond - the benchmark for the region - was close to a two-month high at 0.46%.

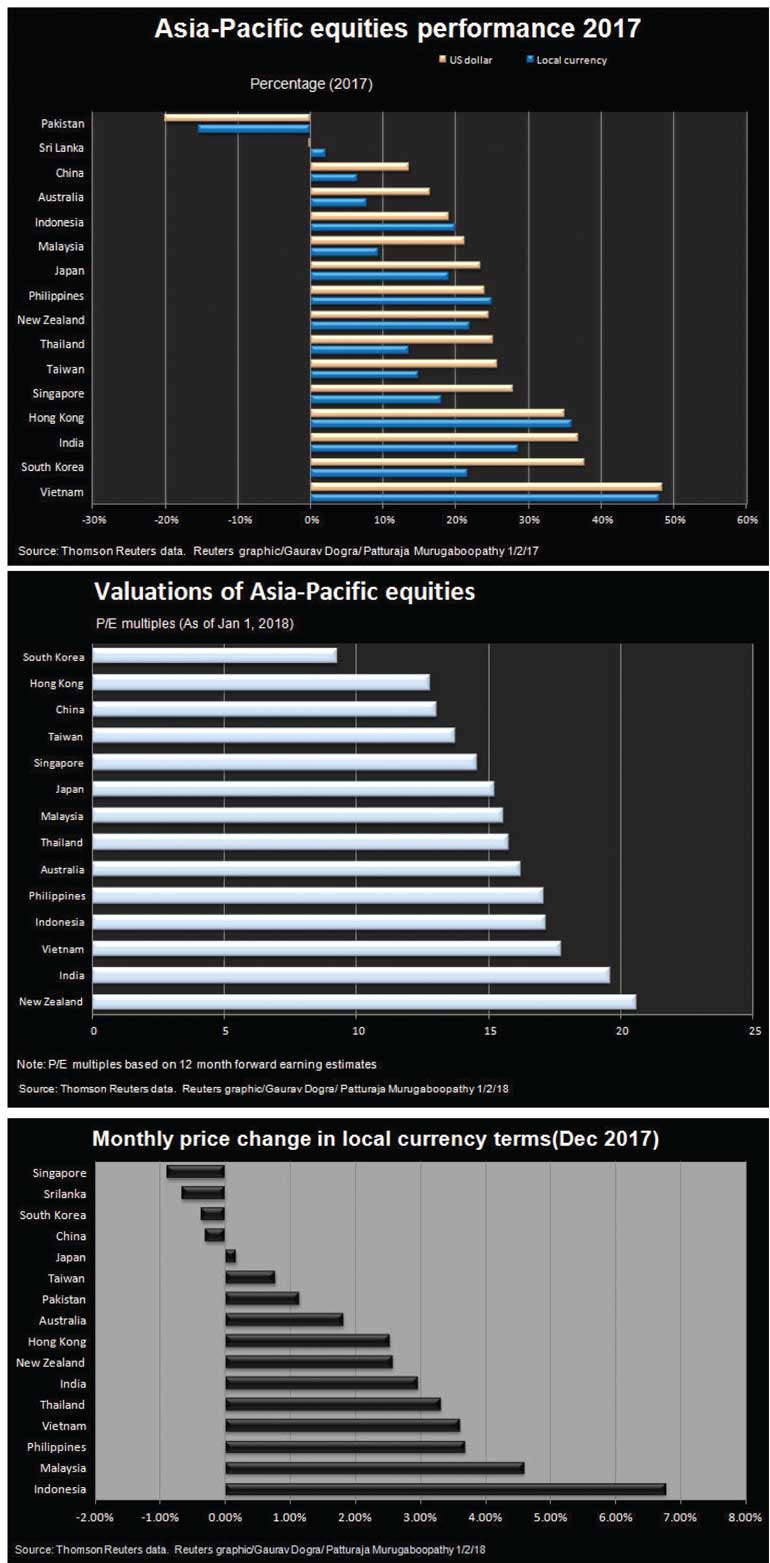

Earlier in the session, Asian stocks struck a range of new peaks: a record high for Philippine stocks, a 24-year top for Thailand and a decade-high for Hong Kong.

MSCI’s index of Asia-Pacific shares outside Japan rose 0.4%, having jumped 1.4% on Tuesday in its best performance since last March.

This after Wall Street started the new year as it ended the old, scoring another set of record closing peaks. The Dow rose 0.42%, while the S&P 500 gained 0.83% and the Nasdaq 1.5%.

The gains in riskier assets came as industry surveys from India to Germany to Canada showed quickening activity.

“The breadth of the recovery is extraordinary,” said Deutsche Bank macro strategist Alan Ruskin, noting that of 31 countries covered, only three failed to show growth while all the largest manufacturing sectors improved. Elsewhere, spot gold reached its highest since mid-September at $1,321.33, before edging back to $ 1,313.81 per ounce.

Oil prices hit their highest since mid-2015, only to stall when major pipelines in Libya and the UK restarted and US production soared to the strongest in more than four decades.Brent crude futures was trading flat at $ 66.57 a barrel, while US crude futures CLc1 nudged up 7 cents to $ 60.43 a barrel.

Nasdaq ends over 7,000 for 1st time, S&P 500 also hits new record

AFP; Wall Street opened 2018 on a winning note Tuesday, bidding Nasdaq to its first-ever close above 7,000 points following a rally in technology shares.

At the closing bell, the tech-rich Nasdaq Composite Index had jumped 1.5% to end the first session of the year at 7,006.90.

The S&P 500 also notched a fresh record, gaining 0.8% to close at 2,695.79, while the Dow Jones Industrial Average rose 0.4% to 24,824.01, about 13 points below its all-time record.

The year’s buoyant start suggested the turning of the calendar has not altered the bullish sentiment that propelled the market to dozens of records in 2017 amid improving earnings and anticipation of a US tax cut plan that President Donald Trump signed into law in December.

Key US data releases this week include auto sales and the employment report for December.

The market was led by technology companies, some of which underperformed in the final weeks of 2017 as money managers steered funds to other sectors.

Apple, Amazon and Google-parent Alphabet all rose close to 2%. And the gains were even bigger for Netflix, which surged 4.8%, as well as several biotechnology companies, including Biogen, which rose 4.9%.

Emerging stocks hit multi-year highs on growth cheer, dollar

London (Reuters): Emerging stocks scaled a more than six-year peak on Wednesday thanks to a tepid dollar and numbers showing the global economy was expanding at a healthy clip.

Turkish inflation data showed little sign of pressure on policymakers’ easing.

With world stocks edging to another record high, MSCI’s emerging market benchmark index advanced 0.6% to trade at its strongest since May 2011.

Bourses in Turkey and the Philippines romped to fresh historic records, while Chinese blue chips gained for the fourth session running. Thailand stocks traded at their strongest in 24-years while Hong Kong rose to a decade high and Russian dollar-stocks jumped more than 1% to their highest in 11 months.

Markets were buoyed by Tuesday’s data showing healthy growth numbers across developed and emerging economies, which also gave a tailwind to commodities.

Adding to the emerging cheer was the dollar languishing close to the more than three months trough hit on Wednesday.

“The dollar is trading on a fairly weak footing at the moment which tends to be supportive for emerging markets, especially those with significant dollar debt like some of the Asian countries, but also Turkey and South Africa,” said Jakob Christensen, head of EM research at Danske Bank.

South Africa’s rand strengthened 0.7%, wiping out the previous day’s losses, while Russia’s rouble added 0.3% supported by Brent oil futures trading firmly above $66.

Turkey’s lira strengthened 0.1% as data showed consumer prices rising 11.92% in December, exceeding expectations and coming in sharply above a government forecast, yet off the 14-year peak it had hit in November.

High inflation is one of the biggest challenges facing the Turkish economy, which has grown strongly after a short-lived downturn following a failed coup in July 2016.

“For the market it’s important to see what it will mean for the central bank – do they have to react again? The market is probably taking the view that there will be higher rates,” said Christensen.

Inflation data is also due in Poland later in the day - the first to release across the region, where numbers often move in tandem. Poland’s figures are expected to show a decline in the annual inflation rate to 2.15%, which could hint at a possible later than projected monetary policy tightening in the region.