Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 28 August 2023 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

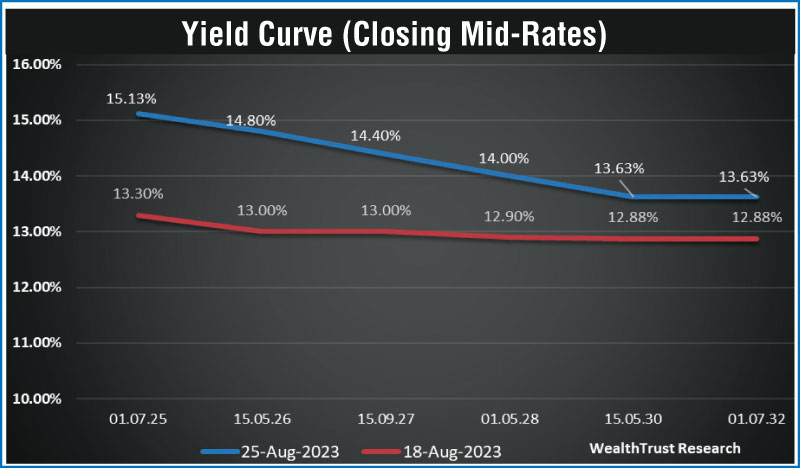

The secondary bond market after commencing off on a lethargic tone, saw activity pick up during the week ending 25 August, with yields surging upwards. This was on the back of the monetary policy announcement and the release of the advance bond auction calendar. The yields on the liquid maturities of 01.07.25, 15.05.26, 15.09.27, 01.05.28 hit intraweek highs of 15.25%, 14.95%, 14.45%, 14.00% respectively against its previous weeks closing levels of 13.20/13.40, 12.95/13.05, 12.95/13.05, 12.85/12.95. This resulted in the yield curve recording a parallel shift up on a week on week basis.

The secondary bond market after commencing off on a lethargic tone, saw activity pick up during the week ending 25 August, with yields surging upwards. This was on the back of the monetary policy announcement and the release of the advance bond auction calendar. The yields on the liquid maturities of 01.07.25, 15.05.26, 15.09.27, 01.05.28 hit intraweek highs of 15.25%, 14.95%, 14.45%, 14.00% respectively against its previous weeks closing levels of 13.20/13.40, 12.95/13.05, 12.95/13.05, 12.85/12.95. This resulted in the yield curve recording a parallel shift up on a week on week basis.

The Central Bank of Sri Lanka (CBSL) on Thursday (25.08.23) kept the policy rates steady, taking a pause on its monetary easing cycle. As such the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) remained at 11.00% and 12.00% respectively.

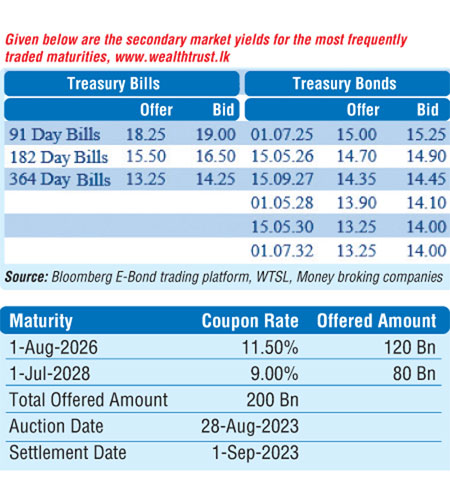

Furthermore, CBSL announced a historically large Treasury Bond auction due today (28.08.23), with a total offered amount of Rs. 200 billion. This trumps the previous highest total offered amount of Rs. 180 billion at an auction held on 13 March.

At the bond auctions conducted on the 13 July, an amount of Rs. 120 billion was taken up in total against a total offered amount of Rs. 100 billion which included the additional 20% offered through the direct issuance window on both maturities. The weighted average rates were recorded at 15.74% and 15.67% on the 01.05.2028 and 15.05.2030 maturities respectively.

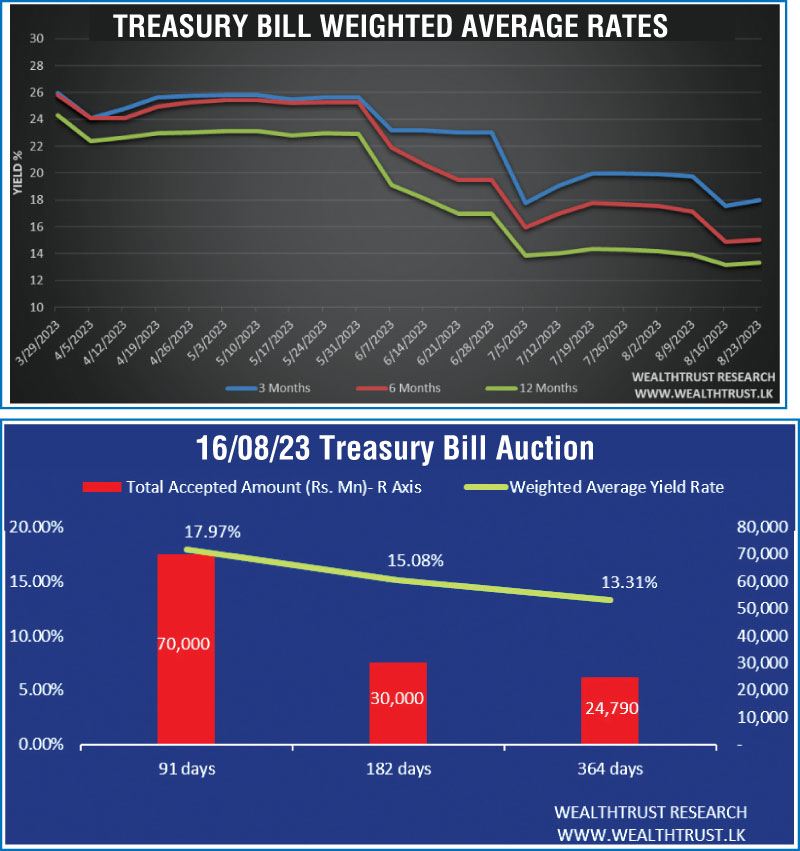

The weekly Treasury Bill auction saw yields reversing the trend of 4 prior consecutive weeks of declines. Accordingly, weighted average rates increased across all 3 maturities. An amount of Rs. 124.79 billion was raised at the 1st phase of the auction against a total offered amount of Rs. 130.00 billion. Additionally, a further Rs. 15.85 billion was raised at its 2nd phase at the respective weighted averages.

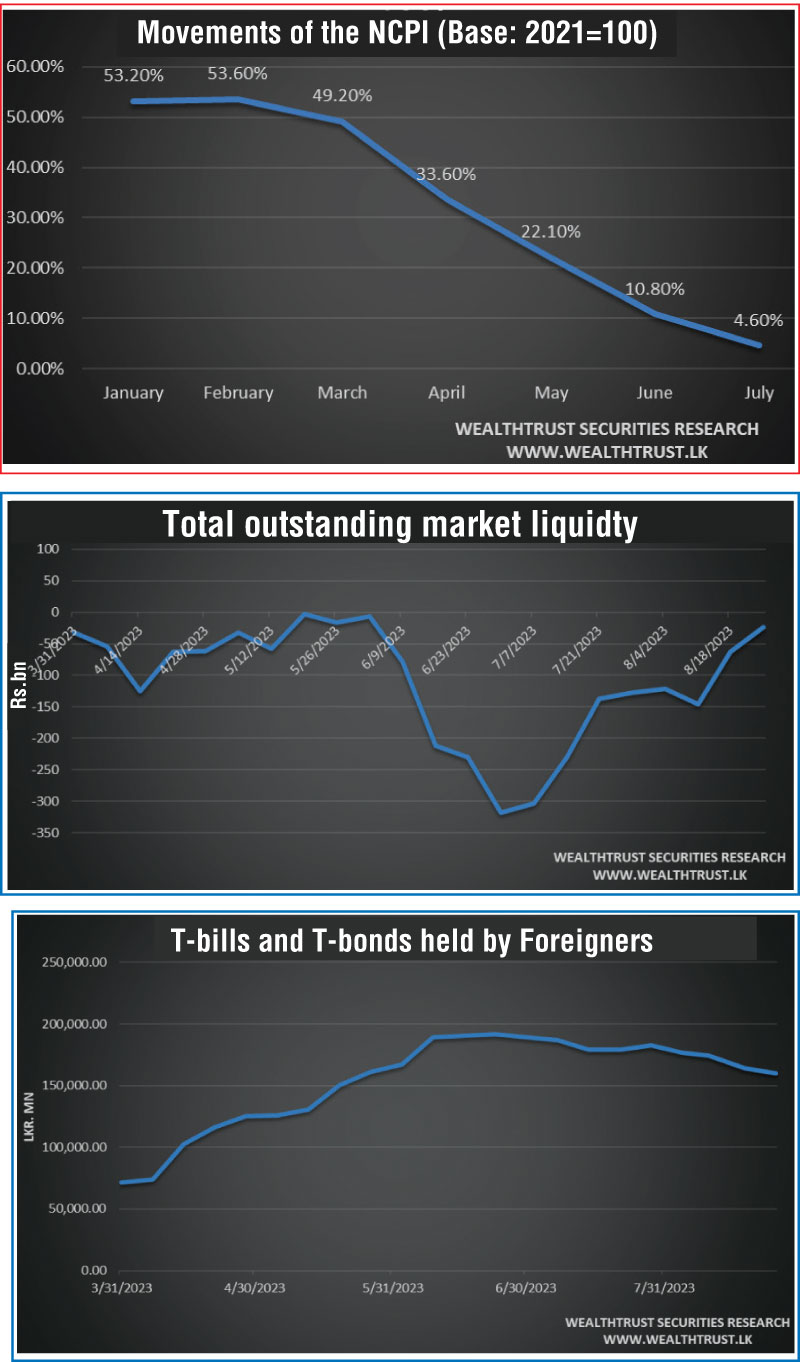

The National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of July decreased sharply to 4.60% on its point to point as against 10.80% recorded in June and a peak of 53.6% in February of 2023. This is so far the lowest level witnessed in the NCPI since the index was rebased, at the start of the year 2023.

The foreign holding in Rupee bonds and bills recorded a further decline with an outflow of Rs. 4.14 billion for the week ending 25 August. This makes 4 weeks of consecutive net outflows totalling Rs. 22.57 billion.

The daily secondary market Treasury Bond/Bill transacted volumes for the first four days of the week averaged at Rs. 21.34 billion.

In money markets, the total outstanding liquidity deficit improved significantly to Rs. 23.55 billion by the end of the week against its previous weeks of Rs. 62.91 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 7-day Reverse repo auctions at weighted average yields ranging from 11.49% to 12.00%.

The Central Bank of Sri Lankas (CBSL) holding of Gov. Security’s was registered at Rs. 2,571.92 billion against its previous weeks of Rs. 2,604.82 billion.

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating marginally during the week to close the week at Rs. 324.00/324.50 against its previous weeks closing level of Rs. 323.00/324.00, subsequent to trading at a high of Rs. 324.75 and a low of Rs. 323.90.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 42.29 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)