Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 12 April 2021 02:31 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

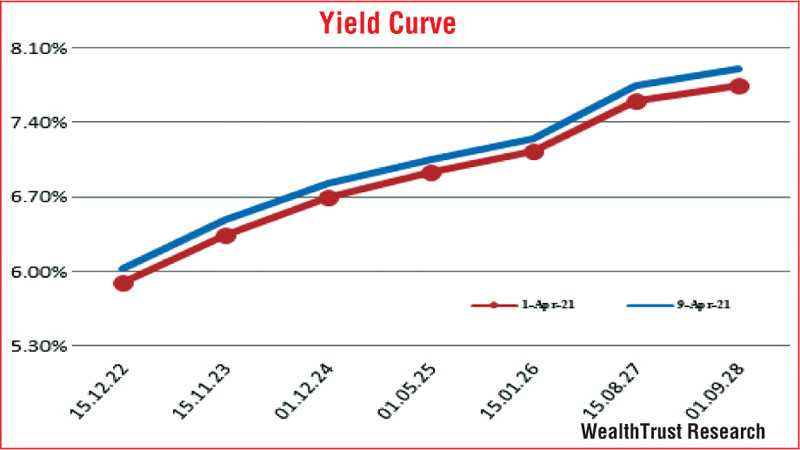

The secondary bond market yield curve recorded an upward shift during the week ending 9 April 2021, as the weekly Treasury bill auction went undersubscribed for a fifth consecutive week and policy rates were held steady by the Central Bank of Sri Lanka at its monitory policy announcement on Thursday.

The secondary bond market yield curve recorded an upward shift during the week ending 9 April 2021, as the weekly Treasury bill auction went undersubscribed for a fifth consecutive week and policy rates were held steady by the Central Bank of Sri Lanka at its monitory policy announcement on Thursday.

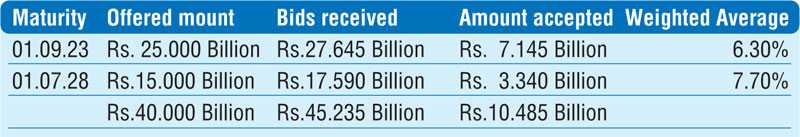

Furthermore, the primary Treasury bond auctions conducted on Friday went undersubscribed as well as its second phase of the auction was opened on both the 01.09.2023 and 01.07.2028 maturities at its weighted average rates of 6.30% and 7.70% respectively as the total offered amount of Rs. 40 billion was not fully subscribed to at its 1st phase of the auction. Nevertheless, only an amount of Rs. 10.49 billion in total was subscribed, recording a short of Rs. 29.51 billion.

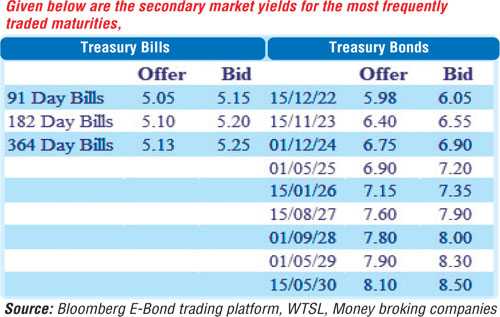

In the secondary bond market, renewed selling interest across the yields curve resulted in yields increasing on the maturities of 2022’s (i.e. 01.10.22 and 15.12.22), 2023’s (i.e. 15.05.23, 01.09.23 and 15.11.23), 2024’s (i.e. 15.09.24 and 01.12.24), 15.01.26 and 15.10.27 to weekly highs of 5.90%, 6.05%, 6.31%, 6.35%, 6.40%, 6.68%, 6.80%, 7.20%, and 8.00% respectively against its previous weeks closing level of 5.83/87, 5.85/95, 6.20/25, 6.20/30, 6.30/38, 6.55/65, 6.65/75, 7.05/20 and 7.50/70.

Foreign holding in rupee bonds remained steady at Rs. 6.20 billion for the week ending 7 April 2021.

Today’s bill auction, conducted two day ahead due to a shortened trading week, will have on offer a total amount of Rs. 45 billion, consisting of Rs. 8 billion on the 91 day, Rs. 15 billion on the 182 day and Rs. 22 billion on the 364 day maturities. At its last week auction, weighted average yields increased across the board by 03, 02 and 04 basis points respectively to 5.08%, 5.12% and 5.15% respectively. The stipulated cut off rate on the 364 day maturity remained steady at 5.15% while the maximum yield rates of the 91 day and 182 day maturities will be decided below the level of the 364 day maturity at the auction.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 6.57 billion.

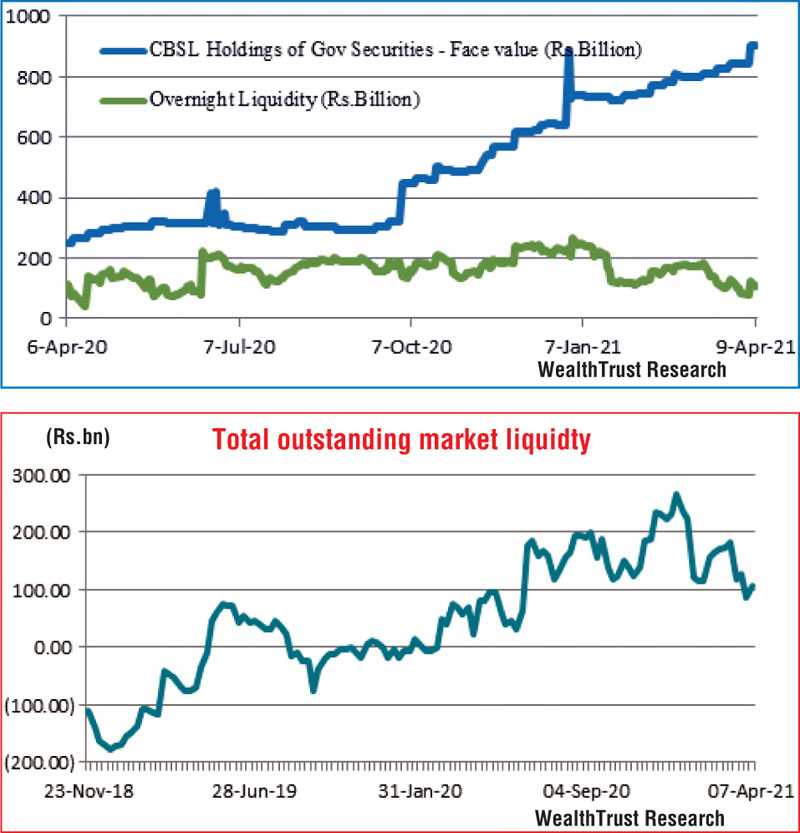

In money markets, the weighted average rates on overnight call money and repo remained mostly unchanged to average 4.64% and 4.66% respectively for the week as the total outstanding market liquidity was seen increasing during the week to a high of Rs.106.77 billion against its previous week of Rs. 86.33 billion. The CBSL’s holding of Gov. Security’s too increased Rs. 903.18 billion against its previous weeks of Rs. 844.02 billion.

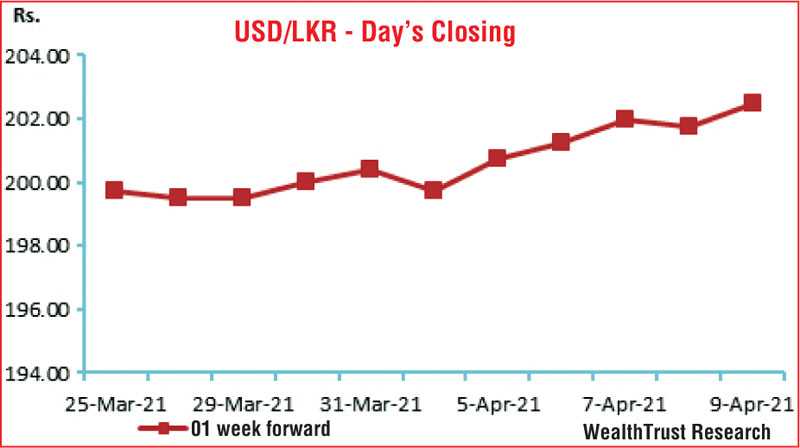

USD/LKR

In Forex markets, the Rupee was seen depreciating marginally during the week as the USD/LKR rate on the more active one week forward contracts were seen closing the week at levels of Rs. 202.00/203.00 against its previous week’s closing level of Rs. 199.50/200.00. The spot contracts traded at levels of Rs. 199.95 to Rs. 200.55 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 74.35 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies.)