Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 12 October 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

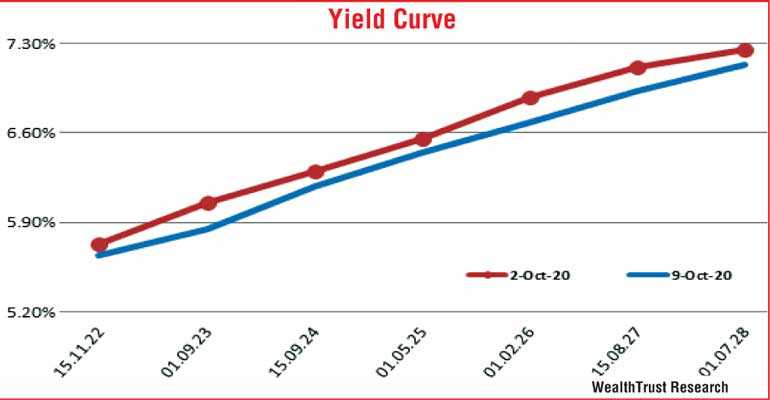

The secondary bond market witnessed renewed buying interest during the week ending 9 October as yields decreased throughout the week to reflect a downward shift of the overall yield curve.

The secondary bond market witnessed renewed buying interest during the week ending 9 October as yields decreased throughout the week to reflect a downward shift of the overall yield curve.

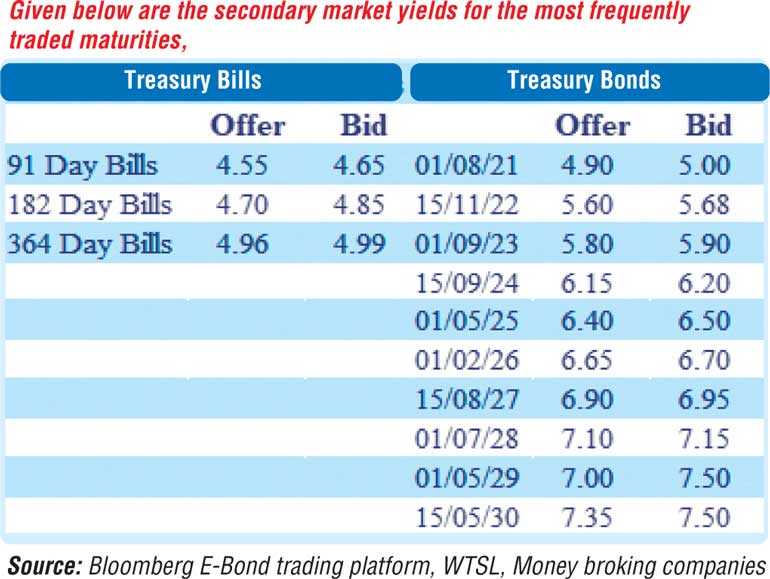

The mostly demanded maturities were the 15.09.24, 01.05.25, 01.02.26, two 2027’s (i.e. 15.08.27 and 15.10.27), and 01.07.28 as its yields dipped to weekly lows 6.20%, 6.45%, 6.67%, 6.95%, 7%, and 7.15%, respectively, against its previous weeks closing level of 6.25/35, 6.50/60, 6.85/90, 7.07/14, 7.10/20, and 7.15/35. In addition, maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23 and 15.10.23), and 15.05.30 were seen hitting lows of 5.70%, 5.72% each, 5.85% and 7.39%, respectively, as well.

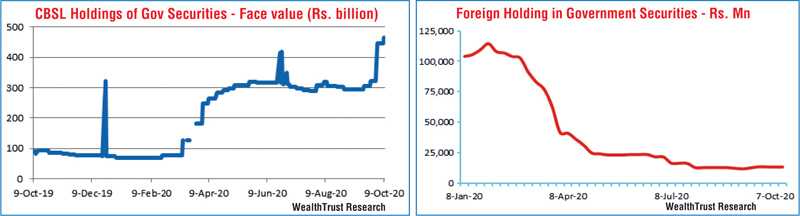

The total subscription volume at the weekly Treasury bill auction increased but still fell short of its total offered amount for a fourth consecutive week while the foreign component in rupee bonds recorded a minute decrease once again for a third consecutive week to record an outflow of Rs. 25 million for the week ending 7 October.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 8.09 billion.

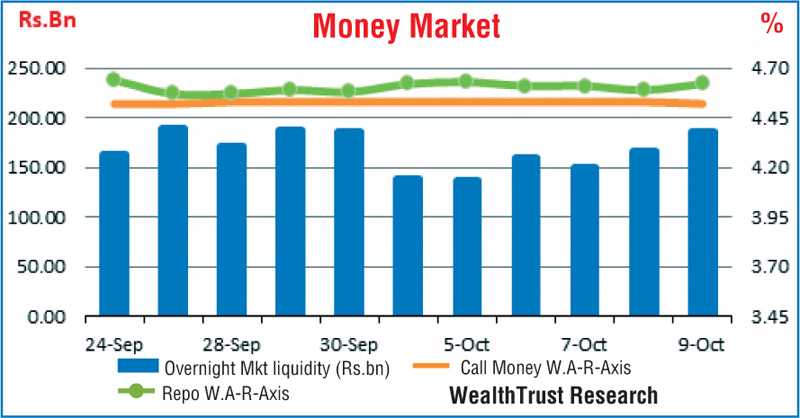

In the money market, the average net overnight surplus liquidity was recorded at Rs. 159.62 billion for the week against its previous week of Rs. 171.58 billion as the DOD (Domestic operations Department) of Central Bank injected liquidity during the week by way of 7-day and 14-day reverse repo auctions at weighted average yields ranging from of 4.53% to 4.54% and 4.55%, respectively. It further injected an amount of Rs. 5 billion for Standalone Primary Dealers by way of a 14-day reverse repo auction at a weighted average rate of 4.88%. The Weighted average rates on overnight call money and repo stood at 4.53% and 4.61%, respectively, for the week while CBSL’s holdings of government securities increased to a face value Rs. 464.13 billion.

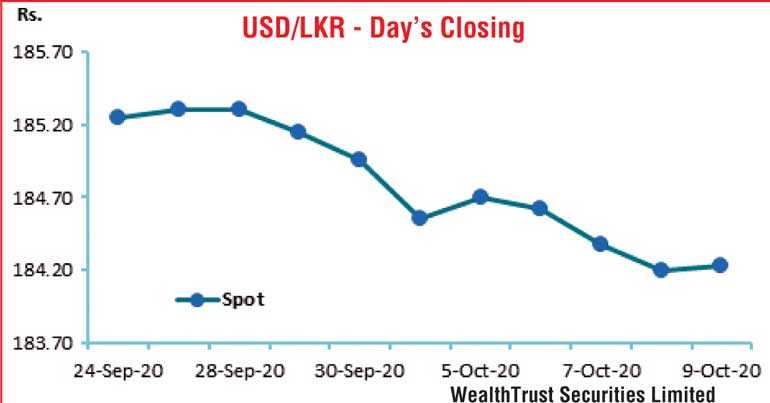

Rupee continues to strengthen

In the forex market, the appreciating trend on the LKR continued as the USD/LKR on spot contacts was seen closing the week at Rs. 184.15/30 against its previous weeks closing level of Rs. 184.50/60, subsequent to trading within the range of Rs. 184.15 to Rs. 184.95.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 117.71 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money

broking companies)