Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 23 October 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

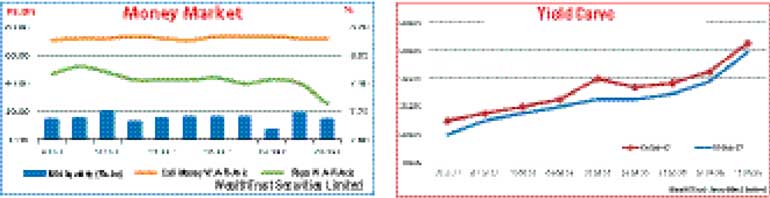

Secondary market bond yields continued to decrease across the board for a second consecutive week, backed by constant buying interest amidst low volumes.

Activity primarily centered around the liquid maturities of 01.05.21, 01.08.24, 15.03.25, 01.08.26 and 15.05.30 with the yields dipping to weekly lows of 10.03%, 10.21%, 10.20%, 10.25% and 10.60% respectively, in comparison to the previous week’s closing levels of 10.05/15, 10.20/30, 10.35/45, 10.30/38 and 10.60/70.

Furthermore, on the short end of the yield curve, the 2018 and 2019 maturities were seen changing hands within the range of 9.15% to 9.50% and 9.70% to 9.80% respectively. In the secondary bill market, the March 2018 maturities traded within the range of 9.00% to 9.05%.

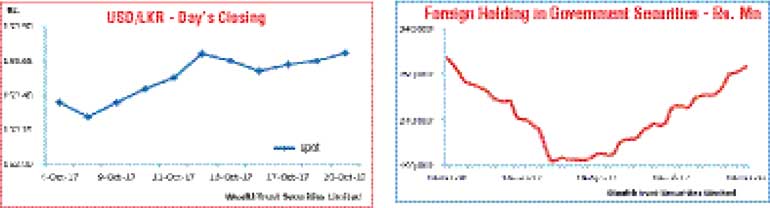

Meanwhile, the foreign holding of rupee bonds continued its upward trajectory for a sixth consecutive week, edging up by Rs. 4.38 billion for the week ending 18 October.

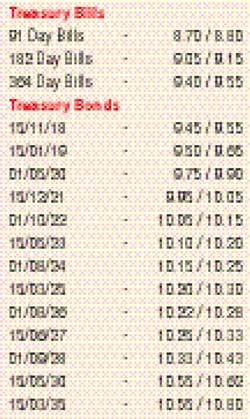

However, at the weekly Treasury bill auction, the weighted average yields increased across the boards by one, two and five basis points respectively on the 91 day, 182 day and 364 day maturities to 8.79%, 9.12% and 9.46%.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 6.45 billion.

In the money market, despite the average net surplus liquidity decreasing to Rs. 14.18 billion during the week ending 20 October in comparison to the previous week’s amount of Rs. 16.06 billion, the overnight call money and repo rates remained mostly unchanged to average 8.15% and 7.88% respectively.

The OMO Department of the Central Bank of Sri Lanka continued to drain out excess liquidity during the week on an overnight basis at a weighted average of 7.25%.

Rupee closes broadly steady

The USD/LKR rate on spot contacts dipped to an intraweek low of Rs. 153.75 during the week before bouncing back to close the week mostly unchanged at Rs. 153.65/73.

The daily USD/LKR average traded volume for the three days of the week stood at $ 42.15 million.

Some of the forward dollar rates that prevailed in the market were one month - 154.50/60; three months - 156.25/35 and six months - 158.70/80.