Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 30 November 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

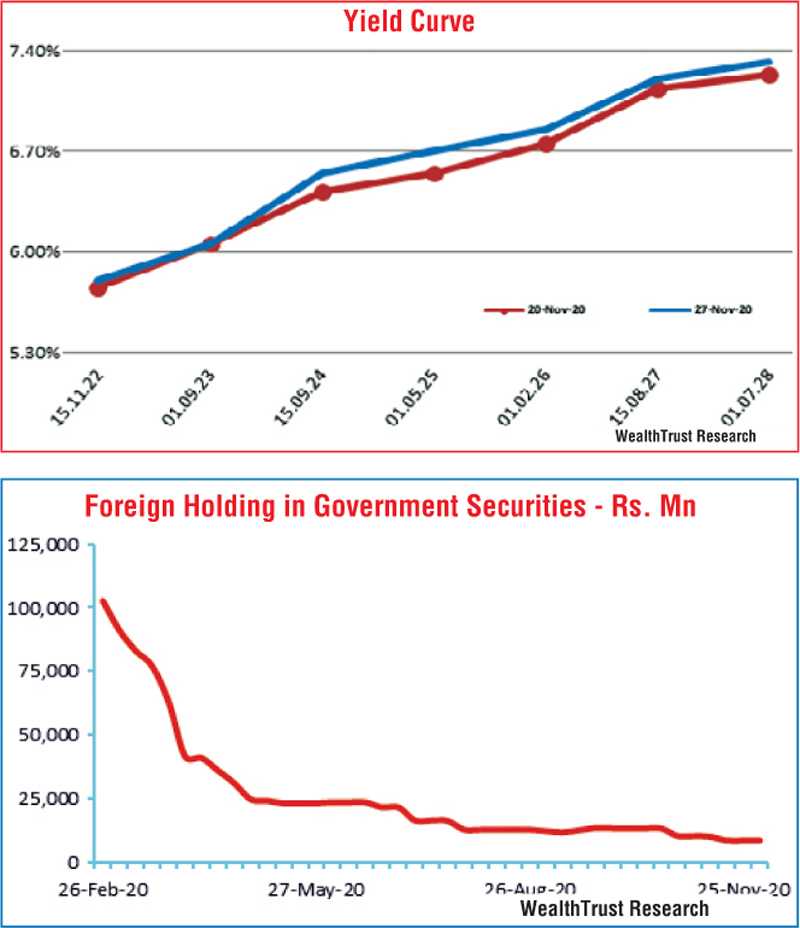

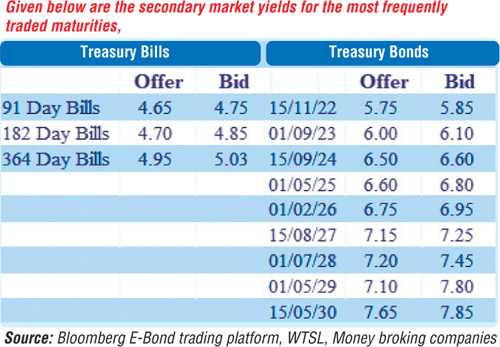

The secondary bond market yield curve was seen steepening marginally during the week ending 27 November, as yields on the very short end of the curve were seen closing the week broadly steady in comparison to its previous week, while yields on the rest of the curve increased.

The secondary bond market yield curve was seen steepening marginally during the week ending 27 November, as yields on the very short end of the curve were seen closing the week broadly steady in comparison to its previous week, while yields on the rest of the curve increased.

Yields on the mostly sorted maturities of 15.12.22 and 15.01.23 increased to weekly highs of 5.90% and 6%, respectively, at the start of the week before bouncing back to weekly lows of 5.76% and 5.85%, leading towards the monitory policy announcement and holding broadly steady subsequent to it, while yields on the maturities of 15.09.24 and 15.08.27 continued to increase to weekly highs of 6.55% and 7.23% from its lows of 6.45% and 7.15%.

In addition, 15.12.23 was seen changing hands within the range of 6.05% to 6.07%, while activity moderated considerably by the end of the week. Meanwhile, the weekly Treasury bill auction was all but fully subscribed, as its total accepted amount was seen hitting a five week high of 95.26% of its total offered amount.

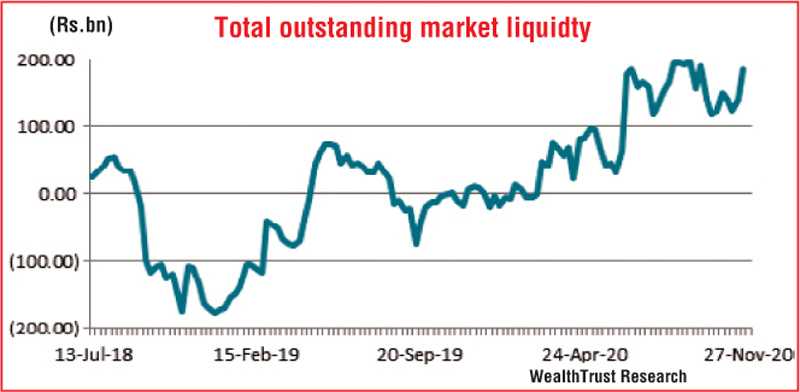

Foreign holding in Rupee bonds remained mostly unchanged with meagre inflow of Rs. 0.31 million for the week ending 25 November.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 15.50 billion.

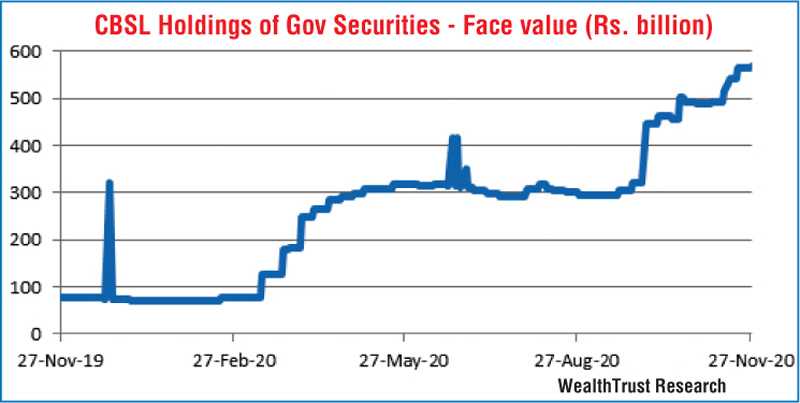

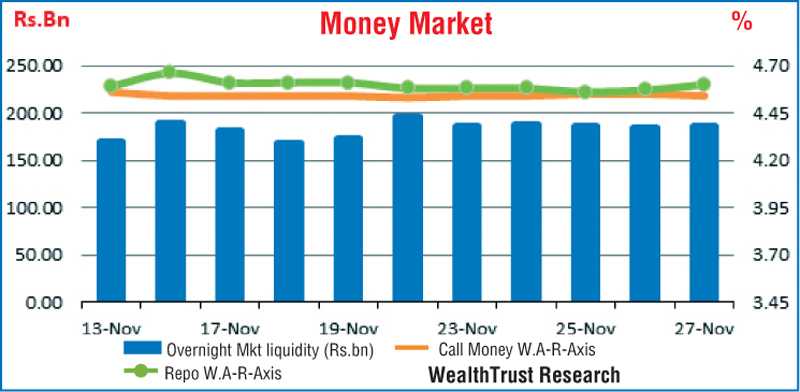

In money markets, the weighted average rates on overnight call money and repo remained mostly unchanged at 4.54% and 4.58%, respectively, for the week, as the total outstanding market liquidity in the system increased further to a surplus of Rs. 186.92 billion against its previous weeks Rs. 185.47 billion. The CBSL’s holding of government securities, too, increased further to Rs. 568.12 billion.

Rupee fluctuates before closing stronger

In forex markets, in the absence of spot contracts being quoted, spot next contracts were seen dipping to a low of Rs. 185.80/95 during the week in comparison to its previous weeks closing of Rs. 185.50/80 before bouncing back to close the week at Rs. 185.30/50.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 69.74 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)