Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 22 April 2020 02:39 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yields closed mostly unchanged yesterday ahead of the weekly Treasury bill auctions due today.

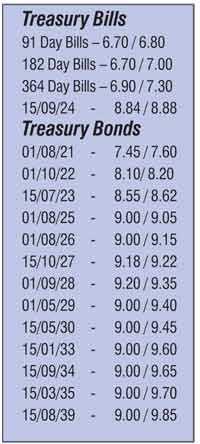

Trades were witnessed on the maturities of 01.03.21, 01.10.22, 2023s (i.e. 15.07.23, 01.09.23 and 15.12.23), 2024s (i.e.15.06.24, 01.08.24 and 15.09.24), 15.03.25 and 15.10.27 at levels of 7.65% to 7.70%, 8.15%, 8.58% to 8.65%, 8.82% to 8.90%, 8.95% to 9.00% and 9.20% respectively.

In the secondary bill market, June and July 2020 maturities were traded within the range of 6.95% to 7.05%.

Today’s weekly bill auction will have on offer, a total amount of Rs. 30 billion, consisting of Rs. 6 billion each of the 91-day maturity and the 182-day maturity and a further Rs. 18 billion of the 364-day maturity.

At last week’s auction, the weighted average yields continued to decrease, with the 91-day and 182-day maturities reflecting decreases of five basis points and five basis point respectively to 6.75% and 6.79%. The 364-day bill remained steady 7%.

In money markets, the weighted average rates on overnight call money and repo stood at 6.45% and 6.57% respectively as the overnight net liquidity surplus stood at a high of Rs. 127.41 billion yesterday. The DOD (Domestic Operations Department) of Central Bank injected an amount of Rs. 0.5 billion by way of an overnight reverse repo auction at a weighted average rate of 6.50% subsequent to offering Rs. 10 billion. A further injection of Rs. 10 billion for seven days drew no successful bids.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded within the range of Rs. 192.50 to 192.75 yesterday.

The total USD/LKR traded volume for 20 April was $ 14.06 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)