Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 24 January 2024 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd

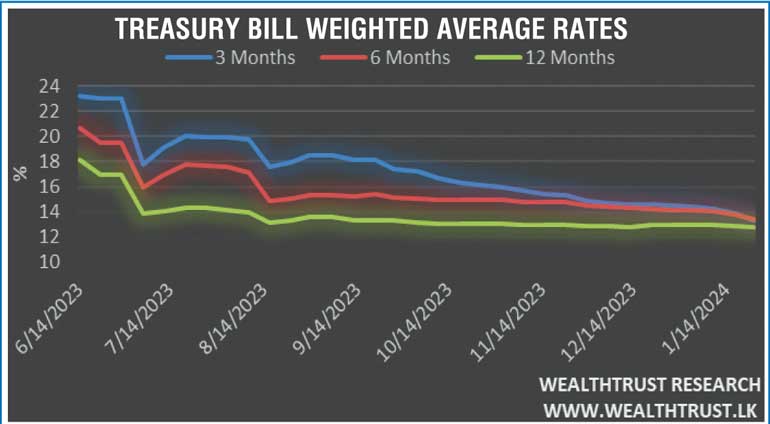

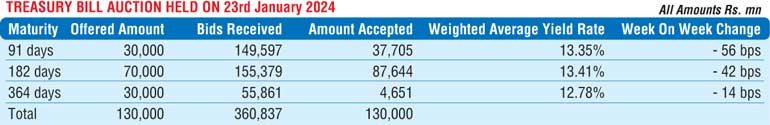

At yesterday’s weekly Treasury bill auction, the weighted averages yields dropped across the board and significantly on the 91-day and 182-day durations. The heavy demand witnessed on the 91-day and 182-day maturities led to the steep decline as bids exceeded the offered amounts. The 91-day maturity reduced by 56 basis points to 13.35%, which saw it drop below the 182-day maturity level for the first time in over a year, while the 182-day maturity also dropped by 42 basis points to 13.41%. The 364-day bill also reduced by 14 basis point to 12.78%, but went undersubscribed. The auction overall saw total bids received exceeding the total offered amount by 2.78 times.

The entire total offered amount of Rs. 130 billion was raised at the first phase of the auction. The second phase of subscription, for only the 364-day maturity will be opened until 4 p.m. on the day before the settlement date (i.e., 24.01.2024) at the weighted average determined at the first phase of the auction. Given below are the details of the first phase of the auction;

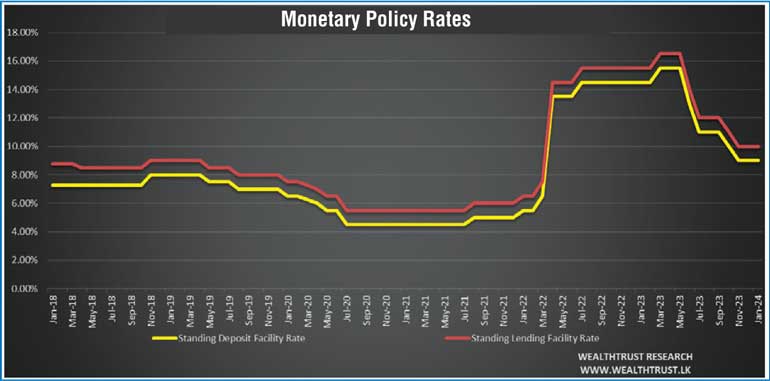

Furthermore, yesterday, the Monetary Policy Board of the Central Bank of Sri Lanka decided to maintain the Standing Deposit Facility Rate (SDFR) at 9% and the Standing Lending Facility Rate (SLFR) at 10%. The press release was cited as saying the decision was based on an assessment of domestic and international macroeconomic factors, aimed to maintain inflation at the targeted 5% over the medium term while supporting economic growth. Despite recognising potential inflationary pressures from recent taxation and supply-side factors, the Board concluded that these developments would not significantly impact the medium-term inflation outlook. Additionally, the Board acknowledged the room for further reduction in market lending rates due to previous easing measures and a decline in the risk premium on Government securities, reiterating the need for financial institutions to promptly pass on these benefits to businesses and individuals.

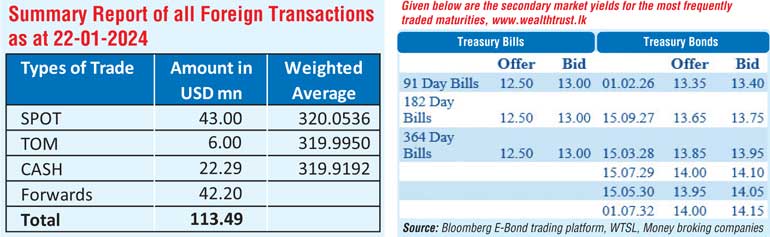

Meanwhile, the secondary bond market, after starting off the day on a subdued note saw activity increase during the latter part of the day. Yields declined on the back of renewed buying interest, spurred by the impressive Treasury Bill auction results. Interest continued to be predominantly on the short to medium end of the yield curve. A buying frenzy on 2026 durations (01.02.26, 01.06.26 and 01.08.26) in particular, saw yields decline from intraday highs of 13.70% to intraday lows of 13.30%, on the back of large volumes. Similarly, trades were seen on the maturities of the three 27’s (15.01.27, 01.05.27 and 15.09.27), three 28’s (15.01.28, 15.03.28 and 01.07.28), 15.05.30 which changed hands between the levels of 13.90% to 13.45%, 14.05% to 13.85% and 14.10% to respectively, on the back of increased activity levels.

Meanwhile in secondary market bills, April and July maturities were seen trading within the range of 13.35% to 12.75% and 13.50% to 13.35% respectively.

The total secondary market Treasury bond/bill transacted volume for 22 January was Rs. 9.85 billion. In money markets, the weighted average rates on overnight call money and Repo stood at 9.09 % and 9.59% respectively while the net liquidity deficit stood at Rs. 79.28 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 54.50 billion at the weighted average rates of 9.26%, while an amount of Rs. 24.78 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 10%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 319.80/319.95 against its previous day’s closing level of Rs. 319.90/320.05.

The total USD/LKR traded volume for 22 January was $ 113.49 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)