Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 1 February 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

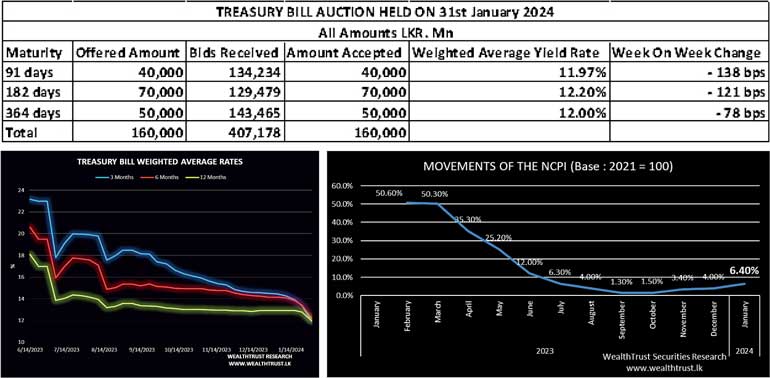

At yesterday’s weekly Treasury bill auction, the weighted averages yields dropped drastically across the board for a second consecutive week. The heavy demand witnessed led to the steep declines, as total bids received exceeded the offered amount by 2.54 times.

The 91-day maturity plunged by 138 basis points to 11.97%, the 182-day maturity by 121 basis points to 12.20% and the 364-day maturity by 78 basis points to 12%. This was the lowest levels seen since March 2022.

The total offered amount of Rs. 160 billion was raised at the first phase of the auction. The second phase of subscription, across all three maturities will be opened until 4:00 pm on the day before the settlement date (i.e., 01.02.2024) at the respective weighted averages determined at the first phase of the auction.

The secondary bond market continued its bull run as robust buying interest pushed yields down further while sizeable volumes were transacted. Yields were seen declining throughout the day, with a surge in activity spurred by the impressive Treasury Bill auction results. Interest continued to be predominantly on the short to medium end of the yield curve. A buying frenzy on 2026 durations (01.02.26, 01.06.26 and 01.08.26) and 2028 durations (15.01.28, 15.03.28 and 01.07.28) saw its yields decline from intraday highs of 12.85% and 13.50% respectively to intraday lows of 12.20% and 12.85%. Similarly, trades were seen on the maturities of the 01.07.25, three 27’s (15.01.27, 01.05.27 and 15.09.27) and 15.05.30 at levels of 12.40% to 11.80%, 13.10% to 12.60% and 13.50% to 13.30% respectively.

On the inflation front, the CCPI or Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of January 2024 was recorded at 6.40% on its point to point as against 4% recorded in December 2023. This was exceeding the median Bloomberg forecast of 5.30% and accelerating to its highest level since September last year. However, this is in line with Central Bank of Sri Lanka (CBSL) projections, as outlined in the latest monetary policy review.

In secondary market bills, March and April maturities were seen trading at 11.25%.

The total secondary market Treasury bond/bill transacted volume for 30 January was Rs. 45.17 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.10 % and 9.63% respectively while the net liquidity deficit stood at Rs. 25.34 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight Repo auction for Rs. 47.63 billion at the weighted average rates of 9.20%, while an amount of Rs. 8.12 billion was withdrawn from Central Banks SLFR (Standing Lending Facility Rate) of 10% and amount of Rs. 30.40 billion was deposited at the Central Bank’s SDFR (Standing Deposit Facility Rate) of 9%.

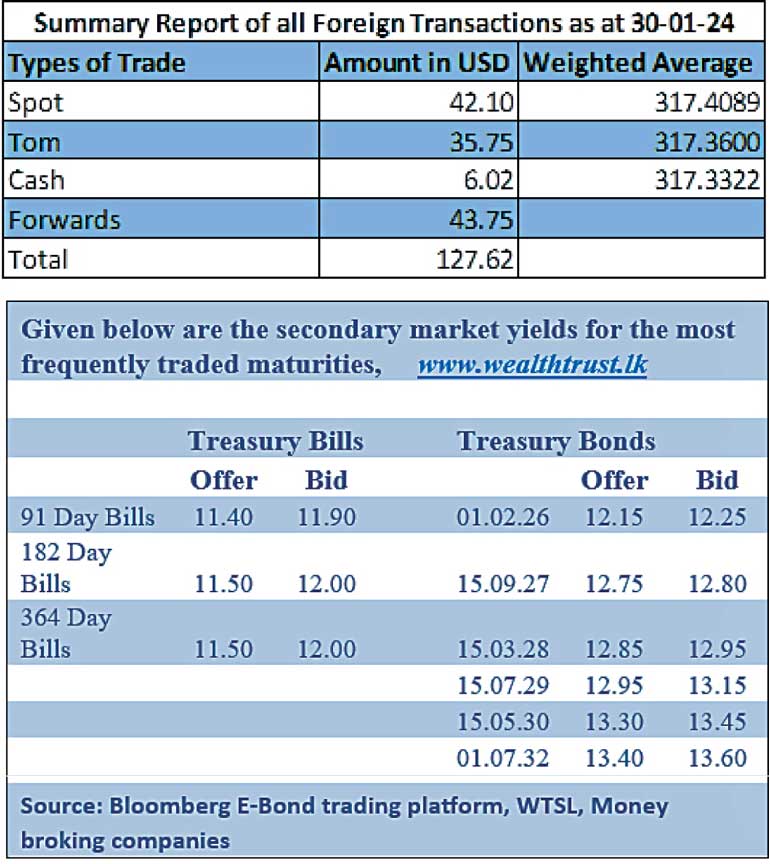

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day up at Rs. 315.50/315.70 against its previous day’s closing level of Rs. 316.90/317.05.

The total USD/LKR traded volume for 30 January was $ 127.62 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)