Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 6 February 2024 00:51 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market kicked off last week on a subdued note but soon gathered momentum with a strong rally midweek, which saw aggressive buying interest pushing yields down drastically.

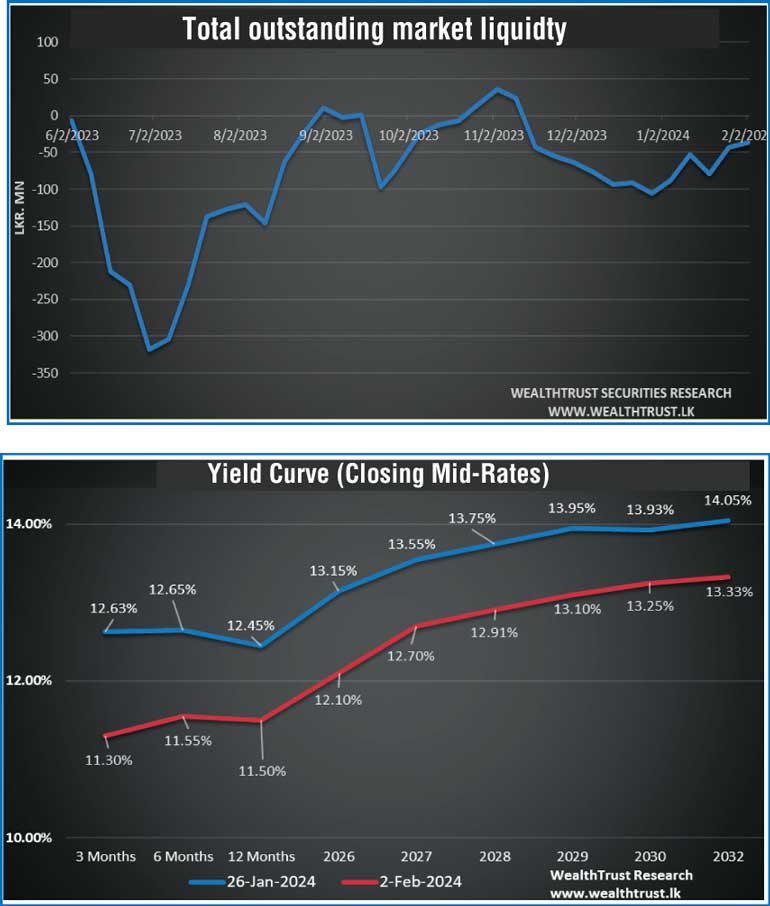

This was spurred by the resoundingly bullish outcomes at the Treasury bond and bill auctions. Trading continued to be centred on the short to medium end of the yield curve, with considerable buying interest observed on 2026, 2027 and 2028 durations. However, some selling interest saw yields edge up last Thursday, which was attributable to the news that Sri Lanka’s external debt private creditors have threatened to lobby the IMF to block the next tranche of funding under the EFF program if the Government fails to make sufficient progress regarding their concerns, which weighed down on investor sentiment.

However, despite this, the bullish sentiment returned at the end of the trading week of 2 February, with yields closing considerably lower compared to the week prior, as the overall yield curve recorded its second consecutive parallel shift down, week on week.

Accordingly, the maturities of three 26’s (01.02.26, 01.06.26 and 01.08.26), two 27’s (01.05.27 and 15.09.27), four 28’s (of 15.03.28, 01.05.28, 01.07.28 and 15.12.28) and 15.05.30 were seen trading within the range of intraweek high and low levels of 13.27% to 12.10%, 13.50% to 12.60%, 13.72% to 12.85%, 13.85% to 13.30% respectively, on the back of considerable activity and large volumes transacted.

At the primary auctions last week, the Treasury bond auctions on 30 January, recorded a bullish outcome in its 1st and 2nd phases, with the entire offered amount of Rs. 40 billion on the 2026 and 2028 durations being snapped up. The total bids received exceeded the total offered amount by a massive 4.46 times. The 15.12.2026 maturity recorded a weighted average rate of 13.08%, while the 15.03.2028 recorded a weighted average rate of 13.65%. An additional amount of Rs. 8.00 billion was raised via a direct issuance window, at its weighted averages determined in the 1st phase, across both maturities. For reference, at the last Treasury bond auction conducted on 11 January, a 2026 duration was issued at a weighted average of 13.83%, while a 2028 duration was issued at 14.21%.

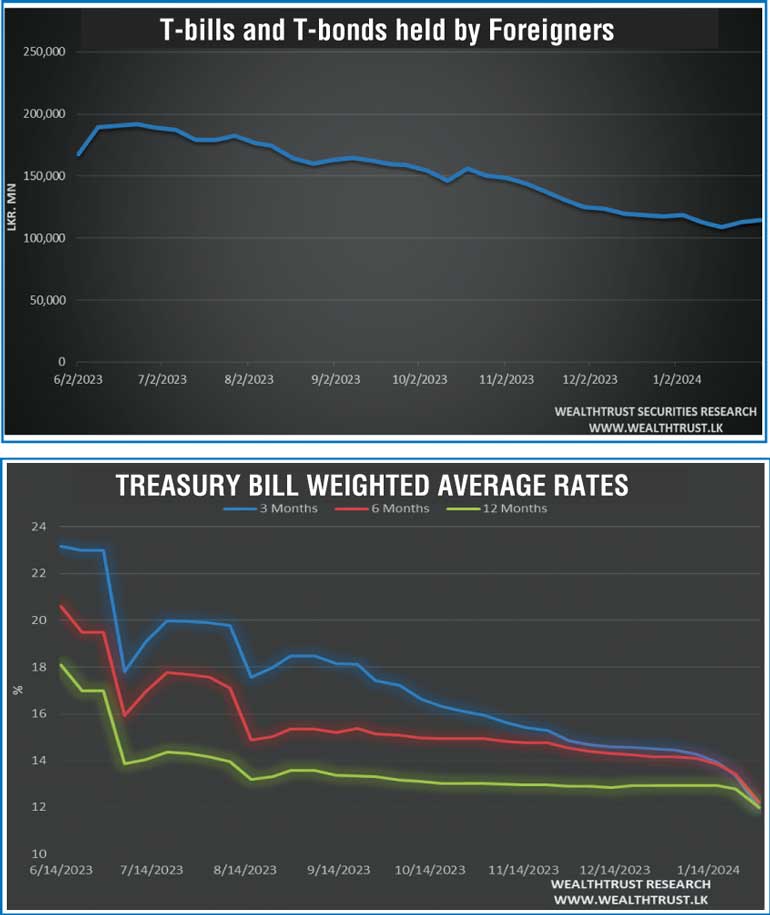

Following this, the Treasury bill auction conducted last Wednesday (31 January), saw the weighted average yields drop drastically across the board for a second consecutive week as well. The heavy demand witnessed led to steep declines, as the 91-day maturity plunged by 138 basis points to 11.97%, the 182-day maturity by 121 basis points to 12.20%, and the 364-day maturity by 78 basis points to 12.00%, falling to its lowest levels seen since March 2022. The total offered amount of Rs. 160.00 billion was raised in the 1st phase of the auction, with a further Rs. 40.00 billion being raised at its 2nd phase. The 2nd phase also went oversubscribed, with bids exceeding Rs. 200 billion.

The foreign holding in Rupee bonds and bills recorded a net inflow for a second consecutive week. As such, the week ending 1 February 2024 saw an inflow of Rs. 1.83 billion, while the total holding increased to Rs. 114.41 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 54.20 billion.

In money markets, the total outstanding liquidity deficit decreased to Rs. 36.61 billion by the week ending 2 February from its previous week’s deficit of Rs. 43.15 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight and term reverse repo auctions at weighted average yields ranging from 9.11% to 10.77%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,755.62 billion as at 2 February 2024, up from its previous week’s level of Rs. 2,753.62.

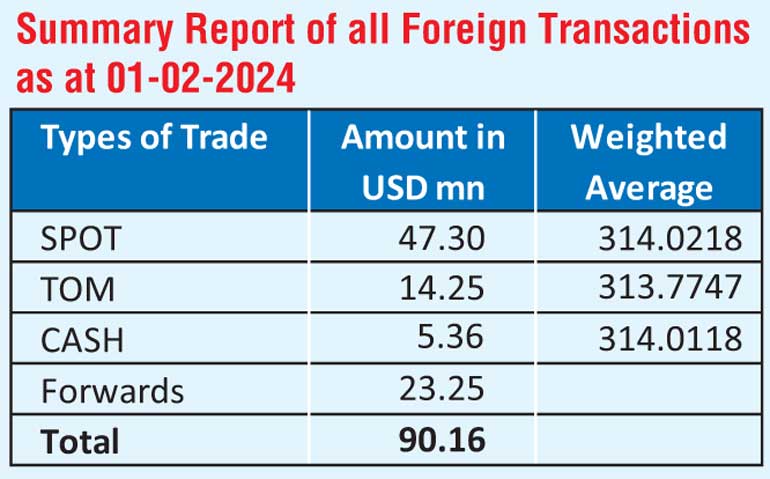

In the forex market, the USD/LKR rate on spot contracts was seen appreciating considerably during the week to close at Rs. 312.25/312.60. This is as against its previous week’s closing level of Rs. 317.50/317.80 and subsequent to trading at a high of Rs. 318.10 and a low of Rs. 310.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 79.09 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)