Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 8 February 2024 04:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

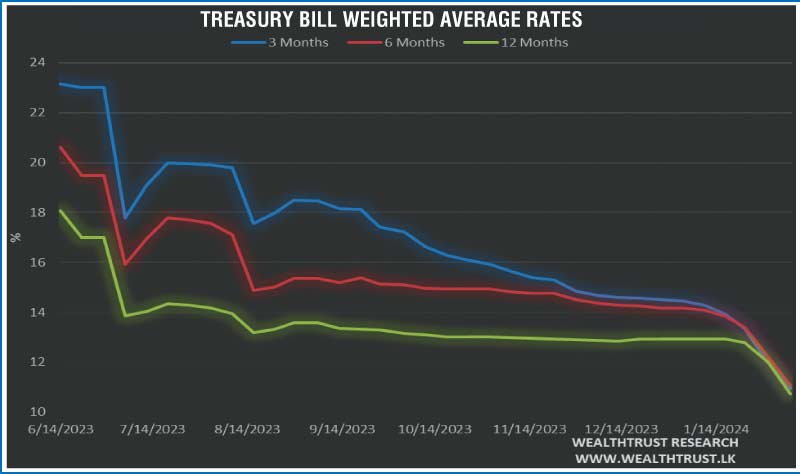

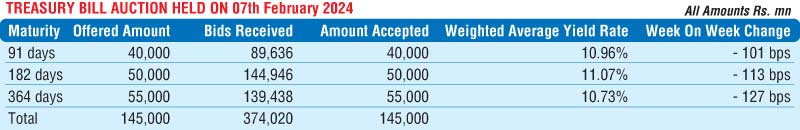

At yesterday’s weekly Treasury bill auction, the weighted average yields dropped dramatically across the board, for a third consecutive week. The heavy demand witnessed led to the steep declines, as total bids received exceeded the offered amount by 2.58 times. The 91-day maturity plunged by 101 basis points to 10.96%, the 182-day maturity by 113 basis points to 11.07% and the 364-day maturity by 127 basis points to 10.73%. The weighted averages on the 3 months and 1-year bills were recorded below 11.00% for the first time since March 2022, hitting almost 2-year lows.

The total offered amount of Rs. 145.00 billion was raised at the 1st phase of the auction. The 2nd phase of subscription, for the 182-day and 364-day maturities will be open until 4:00 p.m. on the day before the settlement date (i.e., 08.02.2024) at the respective weighted averages determined at the 1st phase of the auction.

The secondary bond market yesterday started off on a strong note, with a rally that saw aggressive buying pushing yields to fresh lows, with sizable volumes transacted. This was against the backdrop of positive remarks shared by President Ranil Wickremesinghe while presenting the Government’s policy statement in Parliament. It was stated that Sri Lanka anticipates completing its debt restructuring within the first six months of the year, which he emphasised as ‘foundational’ for economic recovery and debt relief. He expressed optimism for a 2%-3% economic growth in 2024, aiming to boost it to 5% by 2025. Conveying that Sri Lanka is experiencing a V-shaped recovery and plans to reduce the tax burden, seeing room to make adjustments to the VAT percentage to further stimulate economic growth. While also reporting that the island nation is working to rebuild external links to foreign markets.

However, subsequent to the release of the Treasury bill auction results, some profit taking pressure saw yields edge up slightly. Despite this, the market closing two-way quotes across tenors were significantly lower than the previous day. Trading continued to be centred on short to medium tenors. The yield on the 2026 tenors were seen dropping to touch intraday lows of 11.00% as against its intraday highs of 11.60%, while 2028 tenors were seen hitting intraday lows of 12.20% as against intraday highs of 12.45%. Additionally, trades were observed on the maturities of 15.01.25, the two 27’s (01.05.27 and 15.09.27), 15.07.29, 15.05.30 and 01.07.32 at levels of 11.00%, 12.22% to 12.15%, 12.62%, 13.00% to 12.60% and 12.95% to 12.77% respectively.

The total secondary market Treasury bond/bill transacted volume for 6 February was Rs. 16.64 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.10 % and 9.58% respectively while the net liquidity deficit stood at Rs. 12.41 billion yesterday.

The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight Repo auction for Rs. 12.48 billion at a weighted average rate of 9.09% while an amount of Rs. 0.07 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 9.00%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day up at Rs. 313.00/313.50 against its previous day’s closing level of Rs. 314.00/314.50.

The total USD/LKR traded volume for 6 February was $ 57.45 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money

broking companies)