Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 18 January 2024 00:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

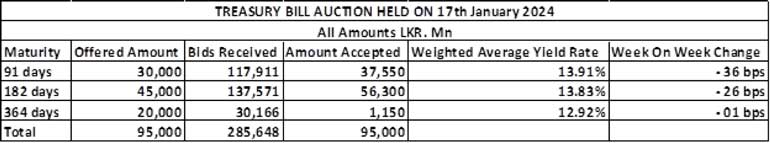

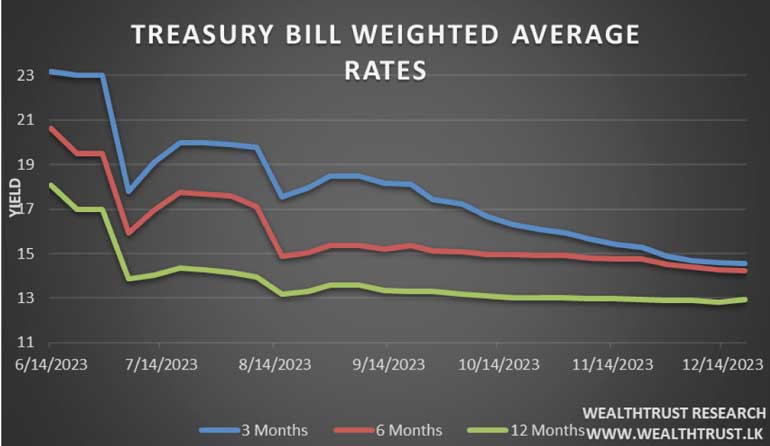

At yesterday’s weekly Treasury bill auction, the weighted averages on the 91-day and 182-day bills were seen dipping below 14.00% for the first time since end March 2022 subsequent to hovering within the range of 14.00% to 15.00% for the past 11 weeks. The 91-day bill recorded the steepest decline of 36 basis points to 13.91%, its eighth consecutive week of easing while the 182-day dipped by 26 basis points to 13.83%, keeping in line with the declining trajectory of market interest rates. However, the 364-day bill reduced only by 01 basis point to 12.92%. The total bids received exceeded the total offered amount by 3.01 times.

The entire total offered amount of Rs. 95.00 billion was raised at the 1st phase of the auction. The 2nd phase of subscription, for only the 364-day maturity will be opened until 4.00 p.m. on the day before the settlement date (i.e., 18.01.2024) at the weighted average determined at the 1st phase of the auction.

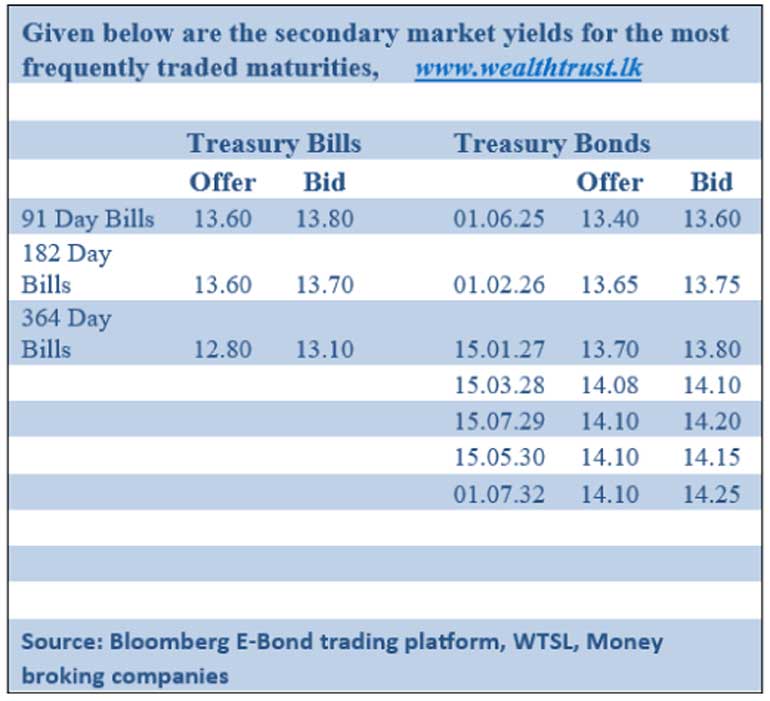

The secondary bond market after starting off the day on a subdued note saw activity pick up. Yields declined on the back of renewed buying interest, spurred by the impressive Treasury bill auction results. Accordingly, trades were seen on the maturities of the 01.02.26, two 27’s (01.05.27 and 15.09.27), 15.03.28, 15.05.30 and 01.07.32 as it changed hands between the levels of 13.75%, 14.00% to 13.91%, 14.19% to 14.05%, 14.13% to 14.00% and 14.25% respectively, while volumes transacted increased as well.

The total secondary market Treasury bond/bill transacted volume for 16 January was Rs. 7.31 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.12% and 10.00% respectively while the net liquidity deficit stood at Rs. 67.32 billion yesterday.

The DOD (Domestic Operations Department) of the Central Bank injected liquidity by way of an overnight auction for Rs. 51.40 billion at the weighted average rates of 9.12%. An amount of Rs. 21.80 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 10.00% while an amount of Rs. 5.88 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 09.00%.

Forex Market

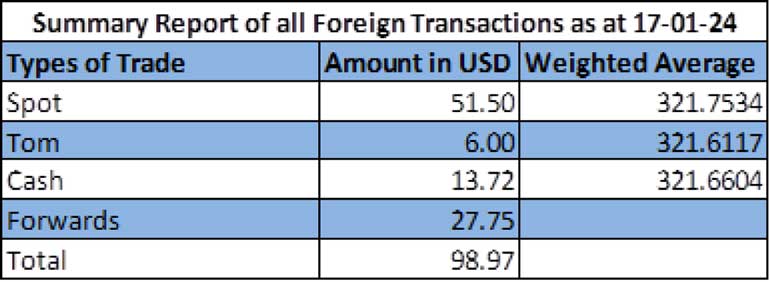

In the Forex market, the USD/LKR rate on spot contracts closed the day at Rs. 320.90/321.10 against its previous day’s closing level of Rs. 321.40/321.60.

The total USD/LKR traded volume for 16 January was $ 98.97 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)