Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 1 July 2024 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

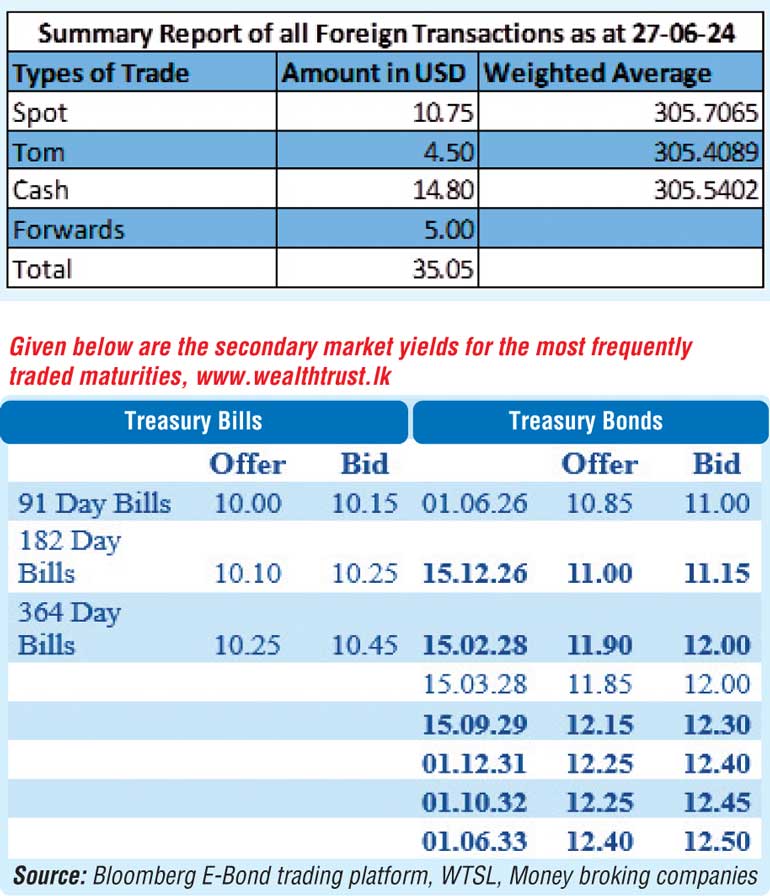

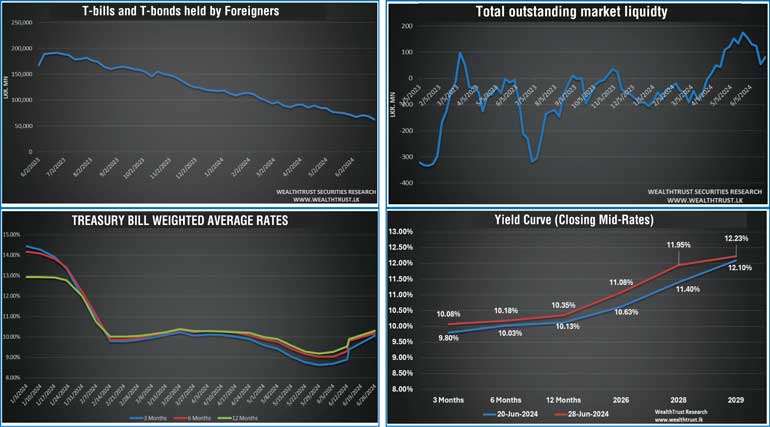

At the weekly Treasury bill auction conducted last Wednesday (26), yields rose for a fourth consecutive week. The steep increase in yields, across all three tenors, exceeded 10.00% for the first time in 9-weeks, since 17 April 2024. The auction was only partially subscribed, raising only Rs. 115.71 billion or 72.32% of the Rs. 160.00 billion offered.

Similarly, at the Rs. 75.00 billion Treasury bond auctions conducted last Thursday (27), yields were seen increasing significantly as well. The 15.02.28 maturity was issued at a weighted average yield of 11.90%, well above a pre-auction market two-way quote of 11.50/60 on a similar maturity. The 01.06.33 maturity, issued at a weighted average of 12.41% was also above a pre-auction two-way quote of 12.10/30 on similar maturities. These results reflect the rising trend in market interest rates for Government Securities.

The secondary bond market last week was characterised by subdued activity, with thin volumes transacted and yields moving up on the back of a bearish sentiment. Market participants were observed adopting a cautious stance, resulting in an effective standstill for much of the trading days, with limited sporadic activity mostly restricted to selected maturities. As a result, at the close of the week the yield curve was observed shifting up further from already elevated levels.

Accordingly, the 2026 tenors of 01.06.26 and 01.08.26 were seen moving up to intraweek highs of 11.00% from lows of 10.70% at the start of the week. This trend was reflected across the yield curve and as such the 15.10.27 maturity was seen trading at a high of 11.03% and the rate on 15.03.28 maturity was observed spiking to a high of 11.85% as against lows of 11.48%. Similarly, the 15.09.29 maturity was observed increasing from an intraweek low of 12.10% to a high of 12.20%. Additionally, the medium tenor bonds; 15.05.30, 01.12.31 and 01.06.33 were seen trading up to the ranges of 12.38% to 12.40%, 12.35% to 12.39% and 12.39% to 12.52% respectively.

The upward movement in the yield curve was despite Sri Lanka achieving a major milestone on its external debt restructuring front, finalising a $ 5.8 billion debt restructuring deal with the Official Creditor Committee, including France, India, and Japan, in Paris. This agreement offers substantial debt relief, allowing Sri Lanka to fund essential public services and secure concessional financing for development. Additionally, Sri Lanka is signing bilateral debt treatment agreements with China’s Exim Bank and engaging with bondholders. The final negotiations with dollar bondholders and the China Development Bank are still ongoing.

The foreign holding in rupee Treasuries for the week ending 27 June 2024, recorded a net outflow for a second consecutive week and to the tune of Rs. 6.48 billion. As a result, the overall holding was registered at Rs. 62.05 billion, falling to the lowest level since 9 March 2023.

The daily secondary market Treasury bond/bill transacted volumes for the first two days of the week averaged at Rs. 19.05 billion.

In money markets, the total outstanding liquidity surplus increased to Rs. 80.39 billion by the week ending 28 June from its previous week’s surplus of Rs. 54.05 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and 7-day term reverse repo at weighted average rates of 8.69% to 8.97%. The weighted average interest rate on call money and repo ranged between 8.71% to 8.75% and 9.00% to 9.23% respectively.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,595.62 billion as at 28 June 2024, down from the previous week’s level of Rs. 2,609.07 billion.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen depreciating during the week to close at Rs 306.00/306.20. This is as against its previous week’s closing level of Rs. 305.10/305.30 and subsequent to trading at a high of Rs. 305.25 and a low of Rs. 306.10.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 55.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)