Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 19 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

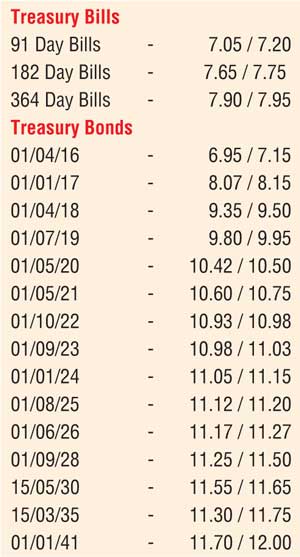

Activity in the secondary bond market moderated yesterday with yields moving in opposite directions on certain maturities ahead of today’s monetary policy announcement.

Selling interest on the 1 May 2020, the two 2021s (1 May 2021 and 1 August 2021) and the 15 May 2030 maturities saw its yields hit intraday highs of 10.52%, 10.70%, 10.75% and 11.60% respectively while buying interest on the 1 October 2022 and 1 September 2023 maturities saw its yields hit intraday lows of 10.95% and 11.00% respectively against its days opening highs of 10.98% and 11.07%.

Meanwhile in money markets, overnight call money and repo rates averaged 6.95% and 6.72% respectively as net surplus liquidity increased marginally to Rs. 14.43 billion yesterday.

The Open Market Operations (OMO) department of Central Bank was seen infusing liquidity on an overnight basis for a third consecutive day, this time for an amount of Rs 3.00 billion at a weighted average of 6.65%.

Rupee remains steady

The USD/LKR rate on the active one week forward contract was seen closing the day mostly unchanged at Rs.144.40/45 against its previous day’s closing levels of Rs.144.45/50.

The total USD/LKR traded volume for 17 February was $ 75.00 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 144.90/10; three months – 146.30/50; and six months – 148.37/42.