Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 16 August 2016 00:11 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

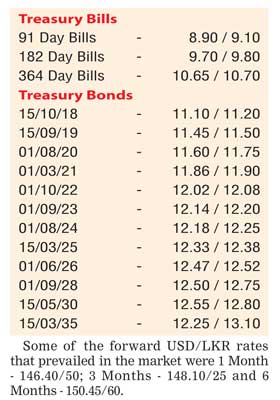

Activity in the secondary bond market dried up considerably yesterday ahead of today’s weekly Treasury bill auction, conducted one day ahead due to a shortened trading week. A very limited amount of activity was witnessed on the 01.03.2021 and the two 2026 maturities (01.06.26 & 01.08.26) within the range of 11.85% to 11.88% and 12.47% to 12.50% respectively.

Today’s weekly Treasury bill auction will see a total amount of Rs.23 billion on offer consisting of Rs. 5.5 billion each on the 91 day and 182 day maturities and a further Rs. 12 billion on the 364 day maturity. At last week’s auction, weighted averages increased on the 91 day and 182 day maturities to 9.01% and 9.92% respectively while the 364 day dipped to 10.72%.

Meanwhile in money markets, an amount of Rs. 45 billion was injected yesterday on an overnight basis at a weighted average of 8.34% as call money and repo rates remained broadly steady to average 8.40% and 8.47% respectively. The net liquidity shortfall in the system stood at Rs. 46.11 billion.

Rupee steady

The USD/LKR rate on the spot, spot next and one week forward contracts remained steady to close the day at Rs. 145.50/55, Rs. 145.52/60 and Rs. 145.72/76 respectively yesterday as markets were at equilibrium. The total USD/LKR traded volume for the 12th of August 2016 was $ 67.50 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 146.40/50; 3 Months - 148.10/25 and 6 Months - 150.45/60.