Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 6 December 2016 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

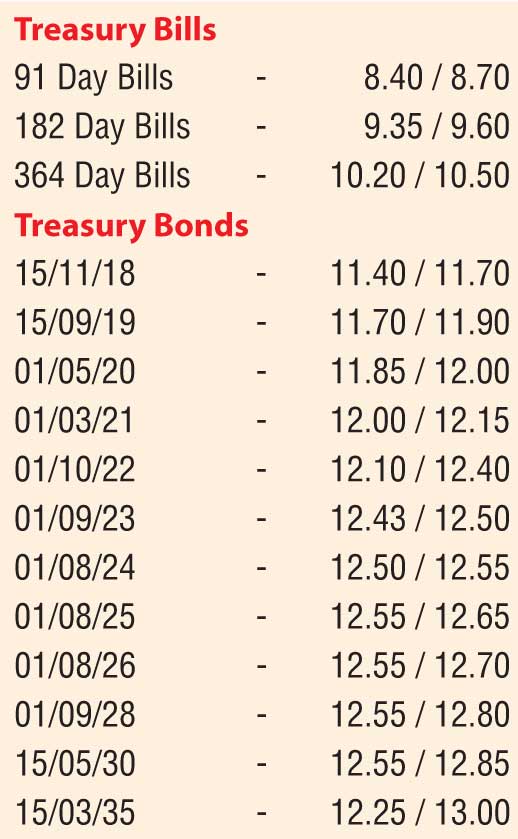

Activity in secondary bond markets came to a standstill yesterday, with the dull momentum continuing for a second consecutive day. The maturities of 15.09.19, 01.09.23 and 01.08.24 were seen quoted at levels of 11.70/90, 12.43/50 and 12.50/55 respectively.

Meanwhile in money markets, overnight call money and repo rates averaged at 8.40% and 8.55% respectively with the net deficit standing at Rs. 9.08 billion. The Open Market Operations (OMO) Department of the Central Bank were seen carrying out five outright auctions yesterday, totaling Rs. 10.00 billion for durations of 94 days, 101 days, 108 days, 115 days and 122 days respectively in order to infuse liquidity.

However, the auctions were unsuccessful for the third consecutive day as no bids were received.

Rupee depreciates marginally

The spot next contracts in the Forex market was seen depreciating marginally yesterday to close the day at Rs. 148.80/95 against its previous day’s closing of Rs. 148.70/80 on the back of importer demand.

The total USD/LKR traded volume for 2 December 2016 was $ 34.75 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 149.60/70; three months - 151.30/40 and six months - 153.60/75.