Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 15 March 2016 00:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

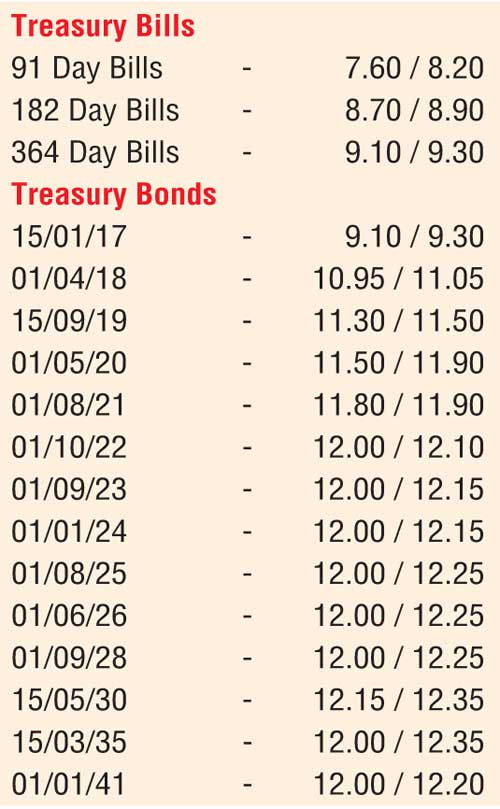

The activity in secondary bond markets dried up drastically yesterday as a bearish market failed to gather any momentum. However, active two way quotes were seen across the curve as yields remained broadly steady. In secondary market bills, the 182 day and 364 day bills were quoted at levels of 8.70/90 and 9.10/30 respectively.

Meanwhile in money markets, the pressure on overnight rates eased yesterday as liquidity remained at a net surplus of Rs 26.53 billion. The averages on overnight call money and repo dipped marginally to 7.82% and 7.79% respectively.

Rupee remains unchanged

In Forex markets, the USD/LKR rate on the active one week forward contract remained mostly unchanged to close the day at Rs.145.20/25 as activity moderated. The total USD/LKR traded volume for 11 March was $ 57.20 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 146.05/15; three months – 147.45/60; six months – 149.60/80.