Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 27 December 2016 00:05 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

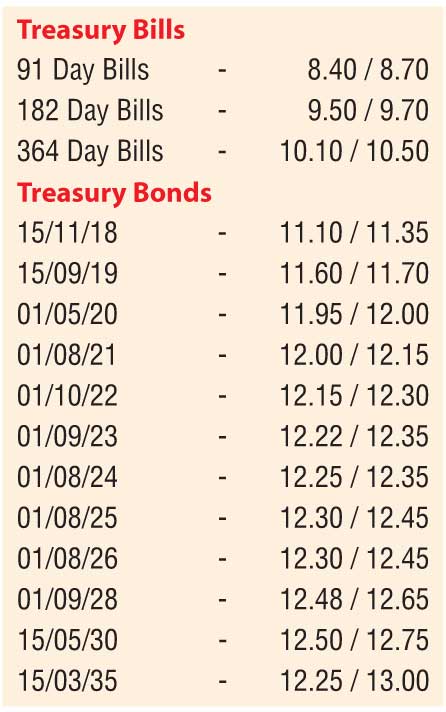

Activity in secondary bond markets increased during the week ending 23 December, with yields declining, as a result of lower volumes being offered at the Treasury bond auction scheduled for 27 December.

Despite the Treasury bond and coupon maturities on 1 January 2017 being Rs. 119.6 billion, the said auction will have on offer only an amount of Rs. 57.00 billion, consisting of Rs. 19 billion each of a 4.02 year maturity of 01.03.2021, 7.07 year maturity of 01.08.2024 and a 9.07 year maturity of 01.08.2026.

Buying interest mainly from local market participants saw liquid maturities of 01.05.20, two 2021 maturities (i.e. 01.08.21 and 15.10.21), 01.09.23 and 01.08.24 dipping to weekly lows of 12.00%, 12.15% each, 12.32% and 12.30%, respectively, against opening highs of 12.20%, 12.25%, 12.40%, 12.44% and 12.55%. Furthermore, buying interest of the 15.09.19, 15.03.25 and 01.09.28 saw its yields decrease to lows of 11.65%, 12.41% and 12.70% respectively against its previous weeks closing levels of 11.80/00, 12.55/70 and 12.85/95.

This was despite the upward trend in weighted averages at the weekly Treasury bill auction which continued for a third consecutive week, with the total accepted amount falling short of the total offered amount for the twelfth (12th) consecutive week. In addition, foreign selling of Rupee bonds too continued for a tenth consecutive week, recording an outflow of Rs. 2.8 billion for the week ending 21 December.

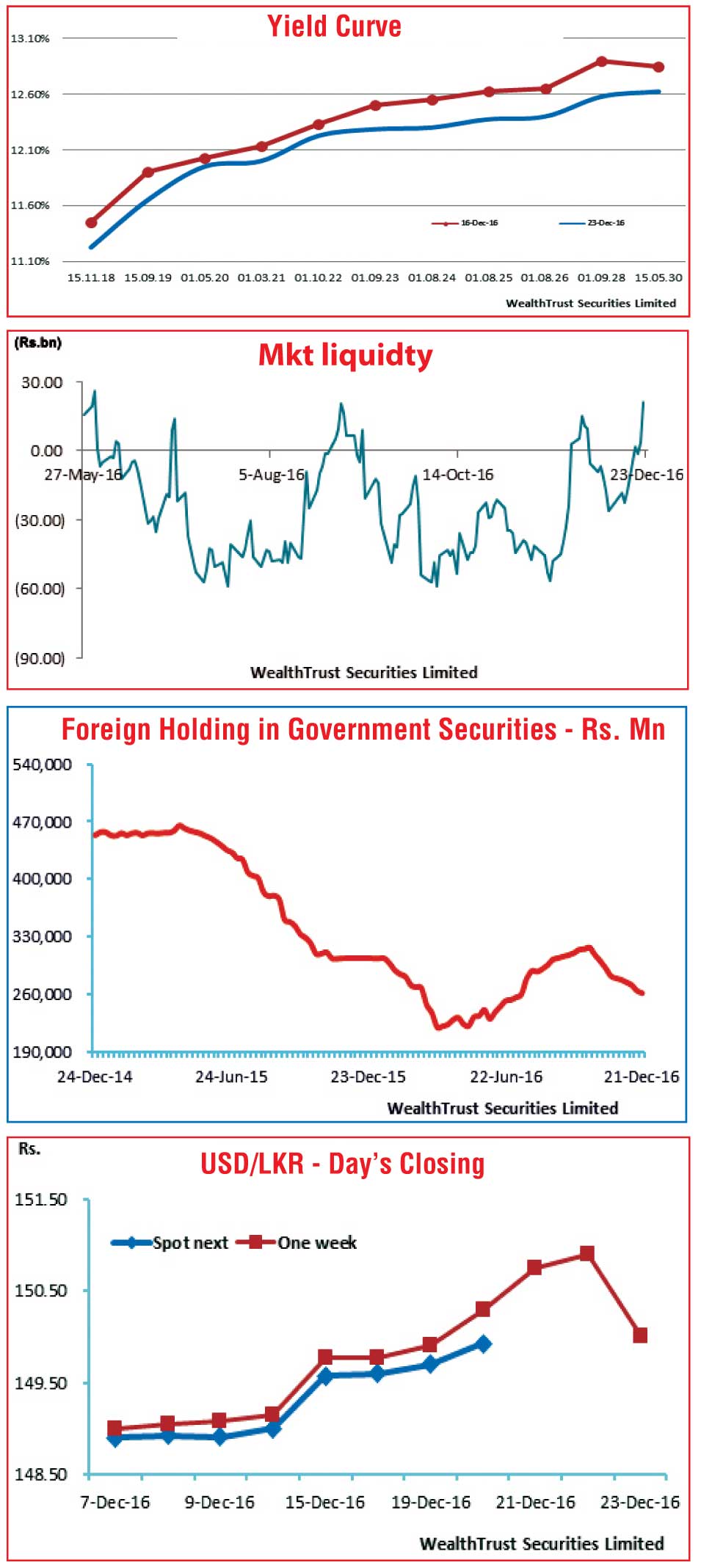

In the money market, the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka was seen conducting overnight repo auctions during the latter part of the week as the average net surplus liquidity in the system increased to Rs. 13.12 billion, against the previous week’s average short fall of Rs. 19.24 billion.

This in-turn led to the overnight repo rate decreasing marginally during the week to average at 8.57% against the previous week’s level of 8.65% while the overnight call money average rate remained steady at 8.42%.

Rupee closes the week stronger

The USD/LKR rate on spot next contacts dipped to an intraweek low of Rs. 149.90 during the early part of the week against its previous weeks closing levels of Rs. 149.55/65 while activity was seen shifting to one week forward contracts during the latter part of the week to close at Rs. 149.90/10 subsequent to hitting intraweek lows of Rs. 150.90.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 57.40 million.

Some of the forward dollar rates that prevailed in the market were 1 month - 150.25/50; 3 months - 152.00/10 and 6 months - 154.20/30.