Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 3 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

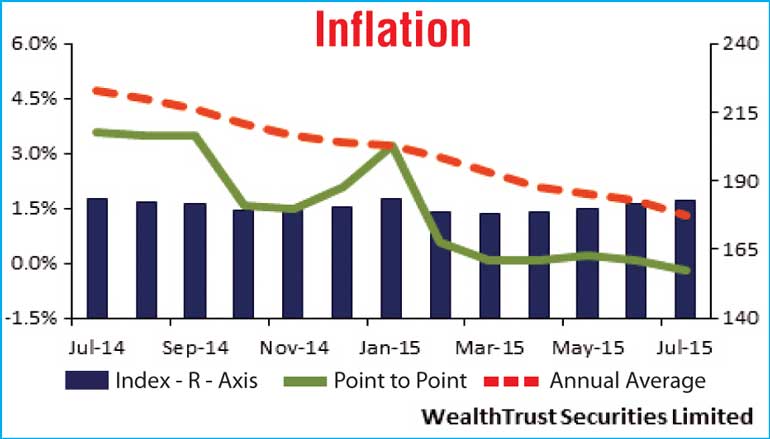

Increasing yields, witnessed in the secondary bond market, during the early part of the week, came to a halt subsequent to the announcement of inflation in July.

Point to Point inflation registered a negative figure of (0.2%) for the first time, based on the 2002 index, while annual average inflation also decreased to a low of 1.3% against its June figure of 1.7%.

This, coupled with an unexpected drop in the weighted averages of the primary bond auction to 8.19% on the 01.07.2019 maturity and 8.87% on the 01.08.21 maturity, and fresh buying interest, resulted in secondary market bond yields decreasing marginally towards the latter part of the week in comparison to the higher yields that prevailed during the early part of the week.

Trading consisted largely of the two liquid maturities of 01.08.21 and 01.09.23, with yields closing the week at levels of 8.91/93 and 9.25/30 against intraweek highs of 8.95% and 9.40%.

Furthermore, a limited amount of activity was witnessed on the 01.06.2018 and 01.07.2019 maturities within a range of 8.80% to 8.87%, and 8.13% to 8.20% respectively.

In contrast, the weighted averages at the weekly Treasury bill auction, continued to rise, with the 91-day, 182-day and 364-day maturities increasing by 03, 05 and 09 basis points to 6.28%, 6.43% and 6.48% respectively.

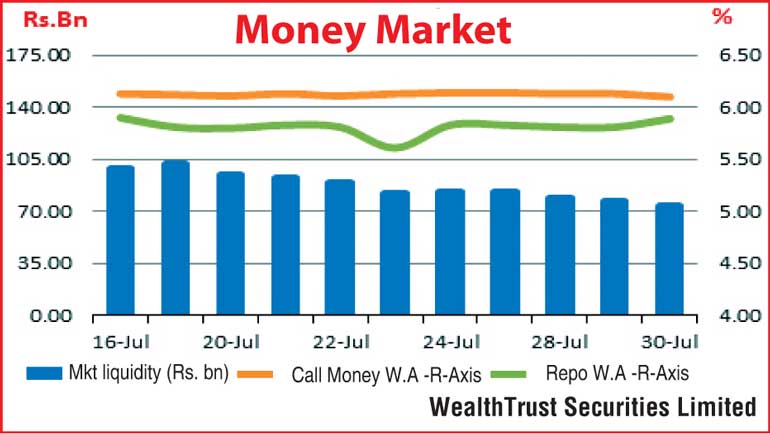

In money markets, the overnight call money and repo rate increased marginally during the week to average 6.13% and 5.84% , against its previous week’s averages of 6.12% and 5.78%, as surplus liquidity dipped to average Rs. 78.37 billion against its previous week’s average of Rs. 88.58 billion.

Rupee appreciates further

The rupee appreciated further during the week to a high of Rs. 133.60 in comparison to its previous week’s closing level of Rs. 133.70. The daily average USD/LKR traded volume for the first three days of the week was at $ 41.55 million.

Some of the forward dollar rates that prevailed in the market were one month - 134.15/25; three months - 135.10/20 and six months - 136.40/60.