Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 19 September 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

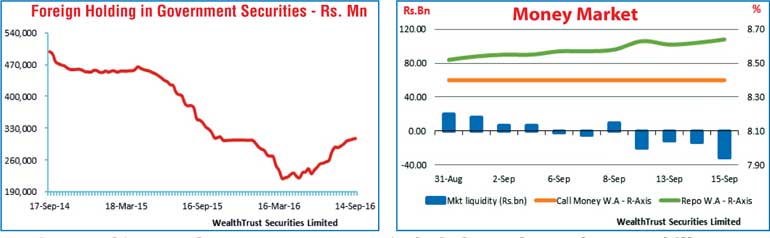

Activity in secondary bond markets increased during the short trading week ending 15th September with yields fluctuating within a wide range.

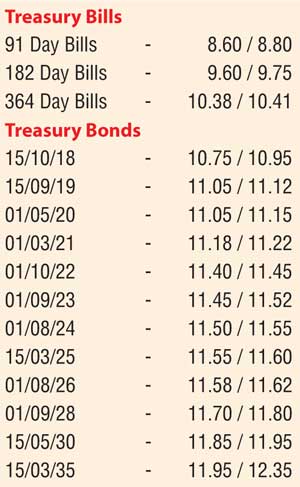

Yields of the liquid maturities of 15.09.19, 01.03.21, 01.10.22, 01.09.23 01.08.24 and 01.08.26 hit weekly highs of 11.20%, 11.32%, 11.57%, 11.64%, 11.65% and 11.76% respectively against its previous weeks closing levels of 10.85/00, 10.95/10, 11.25/33, 11.35/43, 11.52/58 and 11.62/68.

Furthermore, at the weekly Treasury bill auction, the weighted averages remained steady in comparison to the previous week’s  steep drop, with the total bids to offer ratio dipping to an 11-week low of 2.30:1.

steep drop, with the total bids to offer ratio dipping to an 11-week low of 2.30:1.

However, buying interest at these levels, by both local and foreign investors resulted in the yields dipping once gain to hit lows of 11.00%, 11.10%, 11.45%, 11.29%, 11.50% and 11.58% respectively before closing the week at 11.05/12, 11.18/22, 11.40/45, 11.45/52, 11.50/55 and 11.58/62.

Foreign buying of Rupee bonds which has been prevalent over the past 6 weeks, continued with an inflow of approximately Rs.1.4 billion. In the secondary bill market, September 2017 bills were seen changing hands within the range of 10.35% to 10.45%.

In the money market, overnight call money and Repo rates averaged at 8.40% and 8.62% respectively as the Open Market Operations (OMO) Department of Central Bank continuously infused liquidity by way of overnight Reverse repo auctions at weighted averages ranging between 8.48% to 8.49%

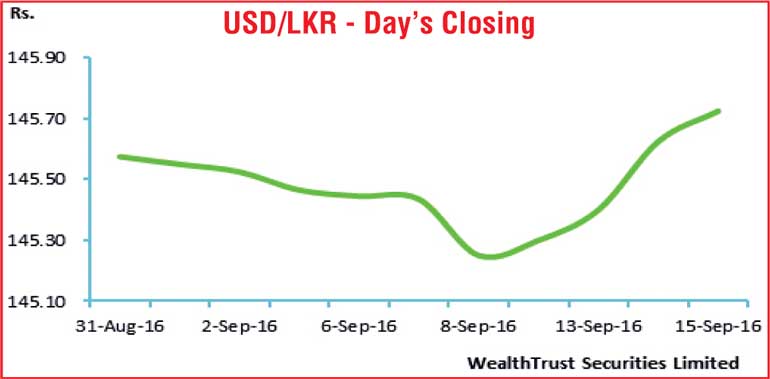

Rupee depreciates during the week

The rupee on spot contracts depreciated during the week to close at Rs.145.65/80 against its previous weeks closing level of Rs.145.25/35 on the back of seasonal importer demand.

The daily USD/LKR average traded volume for the first two days of the week stood at $ 95.77 million.

Given are some forward dollar rates that prevailed in the market: one month – 146.45/55; three months – 148.10/20; six months – 150.55/65.