Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 13 April 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

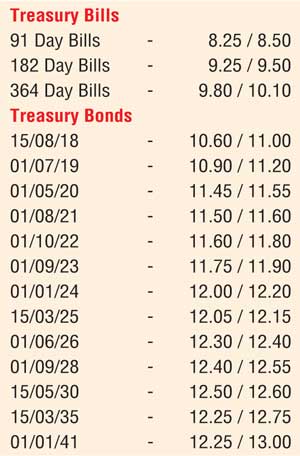

Activity in secondary bond markets moderated yesterday with yields increasing marginally in thin trades, ahead of the holiday period. Limited trades were witnessed on the liquid maturities of 1 May 2020, 1 August 2021, 15 March 2025, 1 June 2026 and 15 May 2030 within the range of 11.45% to 11.50%, 11.55% to 11.60%, 12.10% to 12.15%, 12.30% to 12.35% and 12.51% to 12.60% respectively, whilst 2017 bond maturities were seen changing hands at levels of 10.05% to 10.25%.

In the meantime, the182 day and 364 bills continued to be quoted at levels of 9.25/50 and 9.80/10 respectively in the secondary market.

Meanwhile in money markets, the overnight call money and repo rates remained mostly unchanged to average at 8.15% and 8.21% as the Open Market Operations (OMO) department of Central Bank injected an amount of Rs.65.00 billion at a weighted average of 7.99% by way of an overnight reverse repo auction.

The liquidity in the system stood at a net deficit of Rs.67.66 with a further amount of Rs.10.69 billion being accessed from the Standard Lending facility rate of 8.00% (SLFR) against a deposit amount of Rs.13.35 billion at its Standing Deposit Facility Rate (SDFR) of 6.50%.

Rupee dips marginally

Meanwhile in Forex markets, the USD/LKR rate on active spot next contracts depreciated marginally to close the day at Rs.145.25/50 against its previous day’s closing of Rs.144.90/20 on the back of seasonal importer demand. The total USD/LKR traded volume for 11 April was $ 40.26 million. Given are some forward USD/LKR rates that prevailed in the market: one month – 146.05/35; three months – 147.75/00; six months – 150.05/25.