Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 13 October 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

All bids received for yesterday’s weekly Treasury bill auction were rejected for the first time in thirty weeks as market participants were seen demanding higher yields. Furthermore, the bids to offer ration was seen dipping to a 33 week low of 1:1.62 as well.

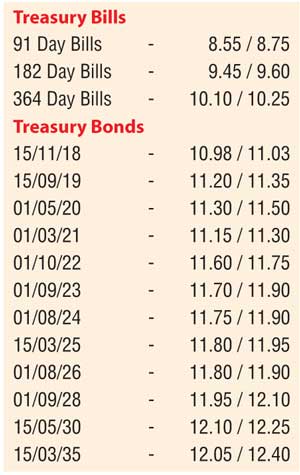

Activity in the secondary bond market was seen moderating once again yesterday. The 15.11.2018, 2019’s (01.05.19 and 15.09.19), 01.08.24 and 01.06.26 maturities were seen changing hands at levels of 11.00%, 11.20% to 11.30% and 11.75% to 11.80% and 11.85% respectively on the back of thin volumes.

In money markets, the overnight repo rate increased further yesterday to average 8.97% as the net liquidity shortfall stood at Rs.42.91 billion. The Open Market Operations (OMO) Department of Central Bank injected an amount of Rs.45.00 billion on an overnight basis at a weighted average of 8.49% by way of an overnight reverse repo auction. The overnight call money rate continued to remain steady at 8.42%.

Rupee appreciates marginally

Meanwhile in Forex markets, the active spot next contracts were seen appreciating marginally to close the day at Rs.147.00/05 against its previous day’s closing levels of Rs.147.05/15 on the back of export conversions outweighing importer demand. The one-week forward contracts closed at Rs.147.15/30. The total USD/LKR traded volume for 11 October was $ 87.65 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 147.85/95; three months – 149.40/50; six months – 151.90/00.