Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 1 March 2017 00:00 - - {{hitsCtrl.values.hits}}

Amãna Bank in 2016 has continued its positive growth momentum in core banking, leveraging on its strategic focus of being primarily an SME and Retail Bank.

Financing Income crossed the Rs. 4 billion mark by end of 2016 to read at Rs. 4.03 billion, corresponding to YoY growth of 40.0% whilst Net Finance Income during the same period grew by 30.0% to Rs. 1.92 billion. The bank continued to gain from Net Fee and Commission Income which recorded a growth of 46.3% in 2016 to reach Rs. 246.5 million. Total Operating Income during the year under review grew by 17.7% to reach Rs. 2.43 billion.

Despite the impressive growth in Core Banking, the bank was able to record only a Profit Before Tax of Rs. 102.8 million for the year, owing to the loss on impairment of Rs. 149.1 million from non-core banking activities. This is attributed to recognizing the impact of underperforming capital market investments under bank’s profits. The bank’s net assets were not affected as a result; due to, which such impact being previously captured under the bank’s reserves were prevalent in the portfolio.

The bank’s total assets grew to Rs. 54.31 billion or by 13.8% during the year. Owing to the strong demand for its multitude of products and services, the bank’s customer deposits and customer advances portfolio grew by 22.0% and 16.3% to read at Rs. 46.91 billion and Rs. 38.45 billion respectively in 2016. At the close of the year, the bank was successful in maintaining a Gross Non Performing Advances Ratio of 0.89%. The bank was also able to maintain a Total Capital Adequacy Ratio of 10.8%, which is predominantly funded by equity capital, resulting in a Core Capital Ratio of 10.4%.

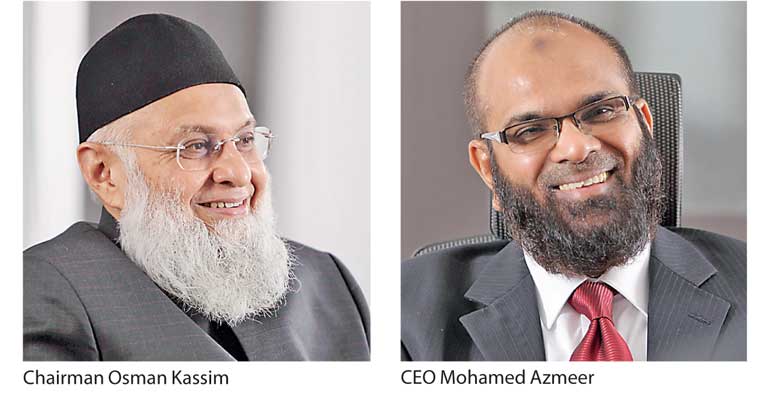

Commenting on the bank’s performance Chairman Osman Kassim said: “Amãna Bank has been growing significantly with overwhelming customer acceptance of its unique banking model. I am thankful for the commitment and determination of the staff, management committee, CEO as well as my fellow board members for the continued success of the bank. We look forward to for further acceleration in our growth journey strengthened by the forthcoming capital infusion.” Also sharing his views Chief Executive Officer Mohamed Azmeer said: “The year 2016 saw the bank achieve significant milestones in line with the bank’s five-year strategic plan. In the year under review we expanded our reach physically as well as technologically while continuing to make great strides in the SME sector, which is a key strategic focus area of the bank. Though the one-off impairment has had an impact to our profits, it is a prudent measure of adopting best practices, which will enable us to focus on our future growth and profitability. Having a belief of ‘superior customer service and innovation’ as key mantras of success, the bank will continue to play a pivotal role in the ever-so changing banking landscape.”

Amãna Bank is the country’s first licensed commercial bank to operate in complete harmony with the globally growing non-interest based Islamic banking model. With the mission of enabling growth and enriching lives, the bank reaches out to its customers through a growing network of 28 branches and 3800+ ATM access points and has introduced a bouquet of customer conveniences such as internet and mobile banking, debit card with SMS alerts, saturday banking, extended banking hours, deposit kiosks and banking units exclusively for ladies.

Fitch Ratings, in October 2016, affirmed the Bank’s National Long Term Rating of BB(lka) with a stable outlook. The bank was recognised as the Best ‘Up-and-Comer’ Islamic Bank of the World by Global Finance Magazine at the 18th Annual World’s Best Banks Award Ceremony held in Washington DC, USA. The bank was also bestowed the coveted title ‘Islamic Finance Entity of the Year 2016’ at the inaugural Islamic Finance Forum of South Asia Awards Ceremony.

Powered by the stability and support of its strategic shareholders including, Bank Islam Malaysia Berhad, AB Bank in Bangladesh and The Islamic Development Bank based in Saudi Arabia, Amãna Bank is making strong inroads within the Sri Lankan banking industry and is focused on capitalising the growing market potential for its unique banking model across the country.