Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 20 December 2016 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

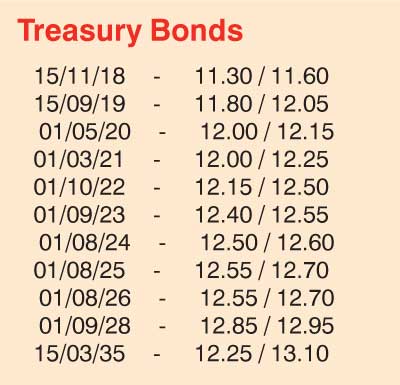

Activity in secondary bond markets continued to be dull with most market participants being on the sidelines. Limited amount of the 01.05.20 and 01.08.24 maturities were seen changing hands within the range of 12.10% to 12.11% and 12.53% to 12.55%  respectively.

respectively.

In money markets, the overnight call money and repo rates remained mostly unchanged to average 8.42% and 8.53% respectively as market recorded a net surplus of Rs.1.87 billion for the first time since 01st December 2016. The attempt to infuse liquidity on a permanent basis by the Open Market Operations (OMO) Department of the Central Bank through outright purchase auctions was unsuccessful once again with all bids being rejected.

The Rupee lost further value yesterday as active spot next contracts were seen closing the day at Rs.149.65/75 against its previous day’s closing levels of Rs.149.55/65.

The total USD/LKR traded volume for 16 November was $ 21.65 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 150.45/55; three months – 151.85/95; six months – 154.35/45.