Thursday Feb 26, 2026

Thursday Feb 26, 2026

Wednesday, 21 September 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

The belly end of the yield curve was seen flatting out yesterday, continuing a similar trend witnessed over the previous few days.

Yields on the six- to 10-year maturities were seen bunching up, driven by selling interest on the 2022-2025 maturities and buying on the 2026 maturity.

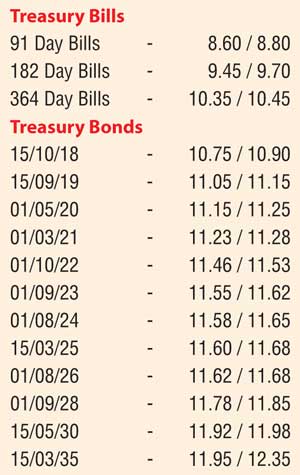

Activity remained high as the liquid maturities of 01.10.22, 01.09.23, the two 2024 maturities (i.e. 01.01.24 and 01.08.24), 15.03.25 and the two 2026 maturities (i.e. 01.06.26 and 01.08.26) were seen changing hands at levels of 11.46%, 11.45% to 11.60%, 11.55% to 11.64%, 11.65% and 11.61% to 11.67% respectively.

Nevertheless, the 01.03.21 maturity continued to change hands at levels of 11.20% to 11.25% and the two longer tenor maturities of 01.09.28 and 15.05.30 at levels of 11.78% to 11.80% and 11.93% to 11.95% respectively.

At today’s Treasury bill auction, a total of Rs. 16 billion will be on offer consisting of Rs. 2 billion on the 91-day, Rs. 3 billion on the 182-day and Rs. 11 billion on the 364-day maturities. At last week’s auction weighted averages on the 182-day and 364-day maturities remained steady at 9.71% and 10.39% respectively while all bids received on the 91-day maturity were rejected. Given below are the closing secondary market yields for the most frequently traded maturities,

Meanwhile in money markets the Open Market Operations (OMO) Department of the Central Bank injected only Rs. 43.48 billion at a weighted average of 8.49% by way of an overnight reverse repo auction as the net liquidity shortfall in the system decreased to Rs. 40.93 billion. The overnight call money and repo rates averaged 8.40% and 9.02% respectively.

Rupee dips further

In Forex markets activity was seen shifting to the one-week forward contacts as it was seen closing the day at levels of Rs. 146.25/45 against its previous day’s closing levels of 146.07/15 on the back of continued importer demand. The spot next contact was quoted at levels of Rs. 146.15/25 while the inactive spot contract was quoted at levels of Rs. 145.85/05. The total USD/LKR traded volume for 20 September 2016 was $ 33.83 million.

Given below are some forward USD/LKR rates that prevailed in the market,

1 Month - 146.90/00

3 Months - 148.55/75

6 Months - 151.10/20