Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 14 December 2016 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

Sentiment in secondary bond markets turned bearish during the week ending 9 December ahead of the FED rate decision, due next week and continued foreign selling interest, which resulted in most market participants adopting a wait and see approach.

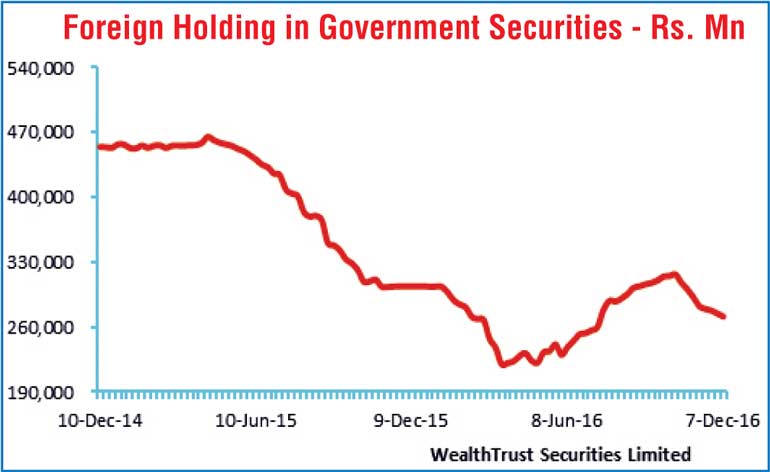

Foreign selling of rupee bonds which had been prevalent over the past seven weeks, recorded an outflow of Rs. 3.3 billion for the week ending 7 December.

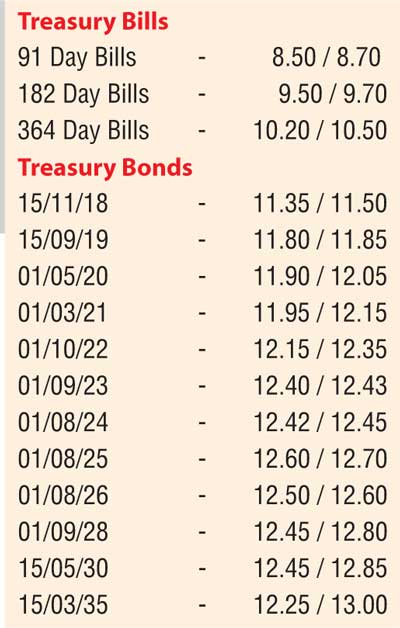

Yields of the 2018 maturities (i.e. 01.02.18, 01.06.18 and 15.11.18) and 2019 maturities (i.e. 01.07.19 and 15.09.19) increased towards the latter part of the week to weekly highs of 10.75%, 11.20%, 11.40% and 11.88% each respectively. Furthermore, the 01.08.24 maturity too, was seen trading within the range of 12.45% to 12.51%. This was despite the weekly weighted averages at the primary Treasury bill auction remaining mostly unchanged at 8.60%, 9.56% and 10.10% respectively.

Meanwhile, next week’s Treasury bill auction will have on offer a total amount of Rs. 25 billion with Rs. 9 billion each of the 182 day and 364 day maturities and Rs. 6 billion of the 91 day maturity.

In money markets, despite the net liquidity shortfall increasing to Rs. 14.14 billion during the week in comparison to last week’s shortfall of Rs. 6.90 billion, the overnight call money and repo rates remained mostly unchanged to average at 8.40% and 8.56% respectively. The attempt to infuse liquidity on a permanent basis by the Open Market Operations (OMO) Department of the Central Bank by way of outright purchase auctions, was unsuccessful, with all auctions being rejected.

Rupee loses during the week

The prevailing importer demand saw the rupee on spot next-next contracts depreciating during the week to close at Rs. 148.90/92 against its previous weeks closing of level Rs. 148.70/80.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 82.65 million.

Given below are some forward dollar rates that prevailed in the market: one month – 149.60/70; three months – 151.10/20; six months – 153.55/60.