Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 18 December 2015 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

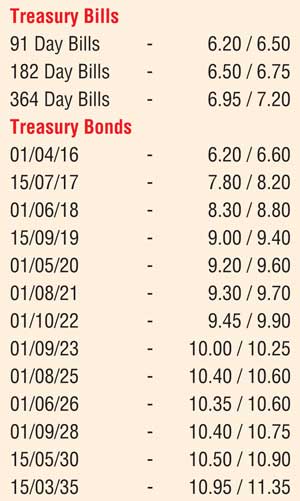

The secondary bond market was at a complete standstill yesterday ahead of today’s Treasury bond auctions, the second round for the week subsequent to weighted averages spiking at Tuesday’s auctions. The increase in the FED fund rate by 0.25% was seen as a further factor in keeping traders on the sidelines. Two way quotes were seen widening further.

Today’s Treasury bond auctions for a total amount of Rs.12 billion will consist of Rs.3 billion each on a 5.00 year maturity of 15.12.2020 and a 14.05 year maturity of 15.05.2030 and Rs.6 billion on a 19.03 year maturity of 15.03.2035. The previous auctions conducted earlier this week fetched weighted averages of 10.36% and 10.86% respectively for the maturities of 01.08.2025 and 15.03.2035 while all bids were rejected for the 15.12.2020. The previously recorded weighted average on the 15.05.2030 maturity was 10.33%.

Meanwhile in money markets yesterday, the upward trend continued as the OMO department of Central Bank was seen draining out an amount of Rs.20.00 billion on an overnight basis at a weighted average rate of 6.13% against its previous day’s average of 6.09%. This intern saw overnight call money and repo rates increase further to 6.39% and 6.14% despite surplus liquidity remaining high at Rs.66.09 billion.

Rupee appreciates marginally

The USD/LKR rate on spot contracts appreciated marginally yesterday to close the day at Rs.143.50/55 against its previous day’s closing level of Rs.143.65/85. The total USD/LKR traded volume for the 16th of December 2015 was US $ 57.68 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.05/25; 3 Months - 145.05/25 and 6 Months -146.30/50.