Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 26 January 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market was at a complete standstill yesterday ahead of yesterday’s monetary policy announcement due at 7.30 pm for the month of January 2016. The announcement of four Treasury bond auctions for a total amount of Rs.15 billion contributed to this dull sentiment further as two way quotes were seen widening and yields increasing mainly on the long end of the yield curve. A very limited amount of activity was witnessed on the 01.11.2019 maturity within the range of 9.90% to 10.00% as most market participants were seen adopting a ‘wait-and-see’

The secondary bond market was at a complete standstill yesterday ahead of yesterday’s monetary policy announcement due at 7.30 pm for the month of January 2016. The announcement of four Treasury bond auctions for a total amount of Rs.15 billion contributed to this dull sentiment further as two way quotes were seen widening and yields increasing mainly on the long end of the yield curve. A very limited amount of activity was witnessed on the 01.11.2019 maturity within the range of 9.90% to 10.00% as most market participants were seen adopting a ‘wait-and-see’  approach. At its last month’s policy announcement (December), the Central Bank of Sri Lanka was seen increasing its Statutory Reserve Requirement (SRR) by 1.50% to 7.50% for all commercial banks.

approach. At its last month’s policy announcement (December), the Central Bank of Sri Lanka was seen increasing its Statutory Reserve Requirement (SRR) by 1.50% to 7.50% for all commercial banks.

Meanwhile in money markets yesterday, the Open Market Operations (OMO) Department of Central Bank was seen mopping up excess liquidity by way of outright sales of Treasury bills. The auctions drained out an amount of Rs.8.5 billion in total against its total offered amount of Rs.20 billion at weighted averages of 6.69% for 17 days and 6.77% for 24 days. The overnight call money and repo rates decreased further to average at 6.80% and 6.58% respectively.

Rupee remains mostly unchanged

In Forex markets, the USD/LKR rate on spot contracts remained mostly unchanged yesterday; to close the day at Rs.143.95/15. The total USD/LKR traded volume for the 22 January was US $ 25.12 million.

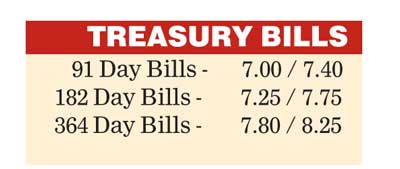

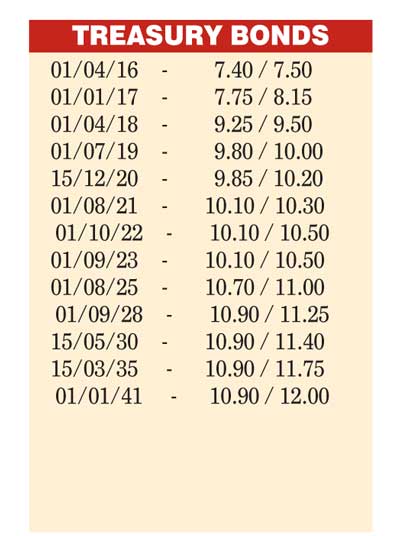

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.55/65; 3 Months - 145.80/90 and 6 Months - 147.65/75. The closing, secondary market yields for the most frequently traded T – bills and bonds,