Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 3 July 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bearish sentiment that prevailed during the beginning of the week ending 30 June was seen reversing to a positive towards the latter part of the week on the back of foreign and local buying interest as yields dipped across the yield curve.

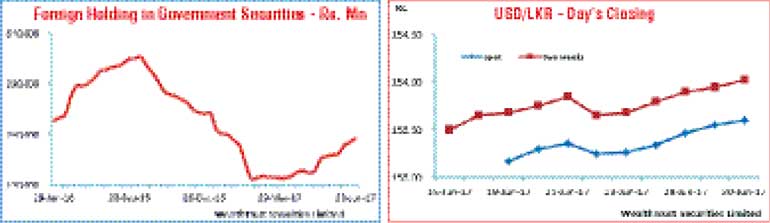

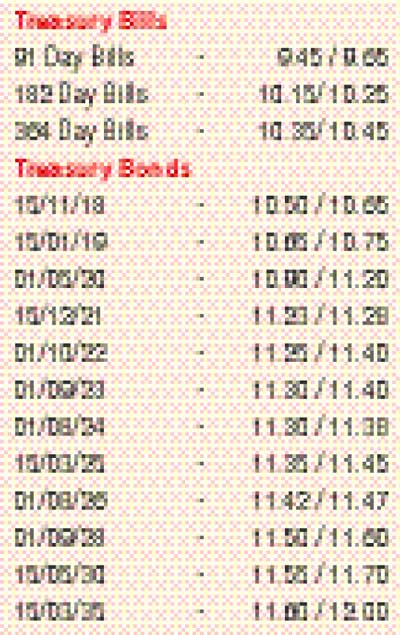

The liquid maturities of the two 2021s (i.e. 01.08.21 and 15.12.21), 01.08.24 and 01.08.26 were seen dipping to weekly lows of 11.27%, 11.25%, 11.38% and 11.45% respectively against its weeks opening highs of 11.40/48, 11.40/50, 11.50/60 and 11.60/70. The bullish momentum was supported by the increase in the foreign holding of rupee bonds for an eighth consecutive week, recording an inflow of Rs. 4.2 billion for the week ending 28 June.

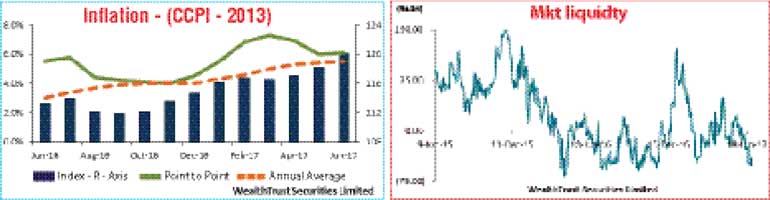

Nevertheless the downward trend in the weekly Treasury bill weighted averages revered during the week as it remained steady for the first time in 10 weeks while inflation (CCPI) for the month of June increased for the first time in three months to 6.1% on its point to point and to 5.5% on its annual average.

The daily secondary market Treasury bond transacted volume for the first three days of the week averaged Rs. 5.66 billion.

In money markets, the net deficit in the system was seen increasing to over a seven month low of Rs. 51.05 billion by 30 June, a level last seen on 17 November 2016. The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka continuously infused liquidity by way of overnight Reverse repo auctions at a weighted average of 8.74%. The overnight call money and repo rates averaged at 8.75% and 8.92% respectively for the week.

Rupee dips during the week

The Rupee on its spot contracts were seen depreciating during the week to close the week at Rs. 153.55/65 against its previous weeks closing of Rs. 153.23/30 on the back of continued importer demand.

The daily USD/LKR average traded volume for the three days of the week stood at $ 10.3.12 million.

Given are some forward dollar rates that prevailed in the market: one month – 154.60/75; three months – 156.70/85; six months – 159.55/75.