Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 12 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The primary and secondary bond market reflected mix fortunes yesterday as yields on the auctioned maturities were seen increasing marginally in comparison to its secondary market yields and previously recorded weighted averages while yields on certain maturities dipped marginally as well.

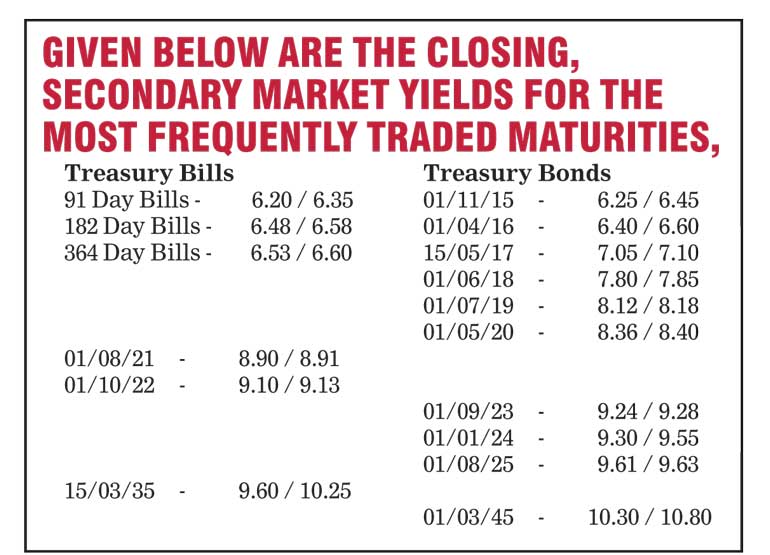

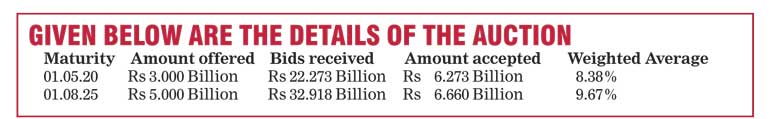

The secondary market yields on the auctioned maturities of 01.05.2020 and 01.08.2025 were seen increasing to intraday highs of 8.40% and 9.64% respectively against its previous day’s closing levels of 8.25/32 and 9.55/62 as the weighted averages on these two stood at 8.38% and 9.67%. The primary auction was oversubscribed once again as a total amount of Rs. 12.9 billion was accepted against its initial total offered amount of Rs. 8 billion. Nevertheless, the yields on the liquid maturities of 01.08.2021, 01.10.2022 and 01.09.2023 were seen dipping to intraday lows of 8.91%, 9.10% and 9.25% respectively against its previous day’s closing levels of 8.94/98, 9.13/15 and 9.28/34 while two-way quotes on the maturities of 01.06.18 and 01.07.19 remained mostly unchanged to close the day at 7.80/85 and 8.15/20 respectively.

Meanwhile, today’s weekly Treasury bill auction will have on offer a total amount of Rs. 20 b, consisting of Rs. 8 b on the 182-day and a Rs. 12 b on the 364-day maturities. At last week’s auction, the weighted average (WAvg) on the 182-day bill increased by seven basis points to 6.50% while the WAvg’s on the 364-day increased by six basis points to 6.54%. The 91-day bill will not be on offer for a second consecutive week.

In money markets, the overnight call money and repo rates decreased marginally to average 6.10% and 5.87% respectively despite surplus liquidity decreasing further to Rs. 69.44 billion.

Rupee remains steady

The USD/LKR rate on spot contracts closed the day steady at Rs. 133.75 yesterday. The total USD/LKR traded volume for the previous day (10-08-15) was US $ 26.30 million.

Some of the forward dollar rates that prevailed in the market were one month - 134.35/50; three months - 135.40/60 and six months - 136.70/00.

Reuters: The rupee ended steady on Tuesday as a state-run bank, through which the Central Bank usually directs the market, sold dollars at a flat rate of 133.75 despite demand for the greenback from importers, dealers said.

The rupee closed at 133.75 per dollar, after the state-owned bank raised the currency’s peg against the dollar by 25 cents on Thursday to allow the exchange rate to depreciate to 133.75.

“There are reluctant sellers and the import demand is there but the rupee ended steady on state bank (dollar) sales,” said a currency dealer who spoke on condition of anonymity.

Steady foreign outflows from government securities, at Rs. 16.75 billion ($ 125 million) in the week ended 5 August, has also put pressure on the currency, dealers said.