Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 20 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

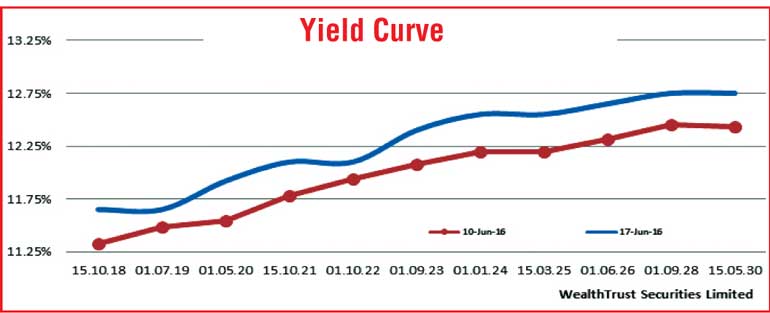

The sentiment in the secondary bond market turned bearish during the week ending 17 June, as yields were seen increasing for the first time in four weeks reversing an downward trend witnessed over the previous three weeks. Local selling interest was seen outpacing foreign buying interest, mainly on the belly end to the long end of the yield curve.

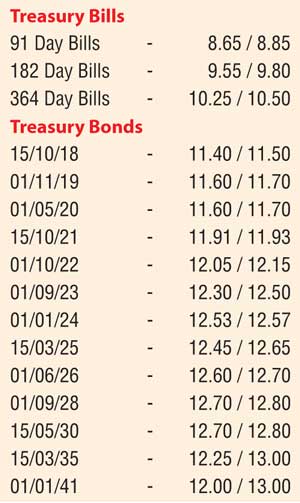

The liquid maturities of 15.10.18, 01.05.20, 15.10.21, 01.01.24 and 01.06.26 which dipped to lows of 11.30%, 11.49%, 11.75%, 12.10% and 12.25% respectively during the week ending 10th June, were seen increasing to highs of 11.45%, 11.65%, 11.92%, 12.55% and 12.63% during the week ending 17 June.

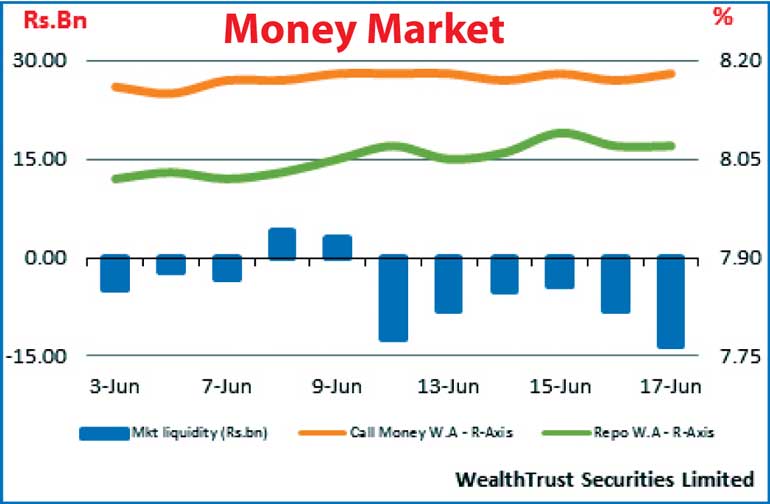

In addition on the long end of the yield curve, the 01.09.28 and 15.05.30 maturities were seen changing hands within the range of 12.55% to 12.70% and 12.65% to 12.75% respectively as the overall curve witnessed a parallel shift upwards week on week. Meanwhile the foreign holding in Rupee were seen increasing for a second consecutive week to record an inflow of Rs.6.6 billion for the week ending 15 June.

Meanwhile in money markets, continued injection of liquidity by the OMO (Open Market Operation) department of Central Bank by way of overnight reverse repo auctions at weighted averages ranging from 7.96% to 8.00% saw overnight call money and repo rates averaging at 8.18% and 8.07% respectively for the week. The net deficit in the market increased to Rs. 7.75 billion.

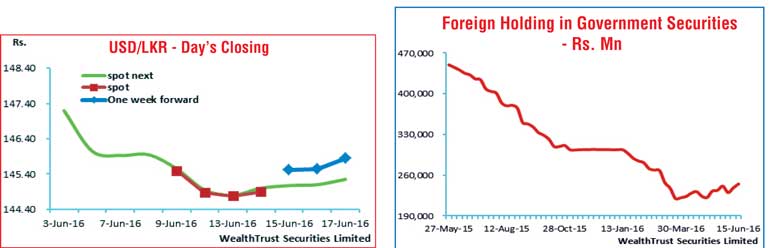

Rupee dips; activity shifts to one week forwards

The USD/LKR rate on its one week forward contract depreciated during the week to close the week at Rs. 145.60/10 while spot and spot next contracts became inactive once again. The daily USD/LKR average traded volume for the first four days of the week stood at $ 74.98 million.

Some of the forward dollar rates that prevailed in the market were one month – 146.25/60; three months – 147.55/85 and six months – 149.70/00.