Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 15 November 2016 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The uncertainties derived from the 2017 budget with regard to the increase in With Holding Tax (WHT) and the tax treatment for government securities was seen tipping an already bearish secondary bond market into a further bearish sentiment.

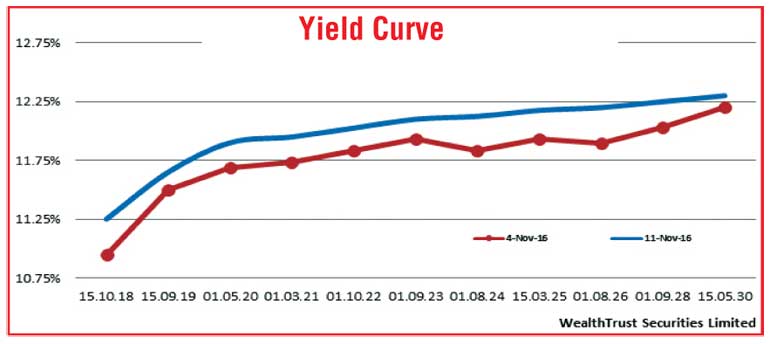

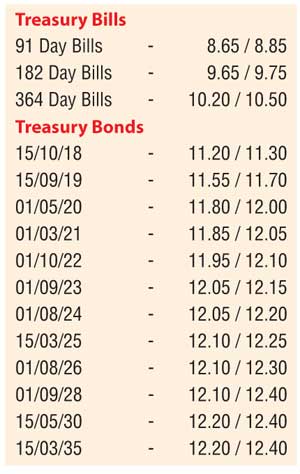

A limited amount of activity witnessed during the week with yield on the liquid maturities of 15.10.18, 15.09.19, 01.05.20, 01.03.21, 01.10.22, 01.09.23 and two 2026 maturities (i.e.01.06.26 and 01.08.26) hitting two months highs of 11.20%, 11.62%, 11.85% each, 12.05%, 12.11% and 12.12% respectively against its previous weeks closing levels of 11.00/10, 11.50/55, 11.67/70, 11.71/75, 11.75/90, 11.85/00 and 11.85/95. The upward trend in yields was further supported by the outcome of the weekly Treasury bills auction, at where weighted averages were seen increasing once again reversing a decrease witnessed over the previous week.

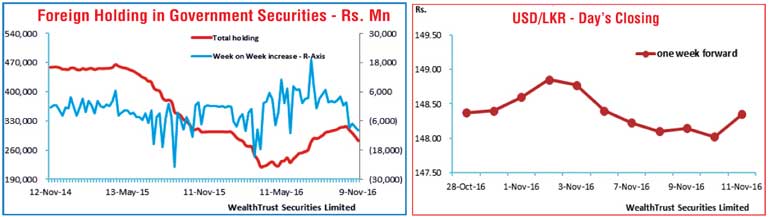

Following the budget reading on Thursday 10 November, two way quotes in the secondary bond market was seen widening an increasing further as well, reflecting an upward parallel shift of the overall yield curve. In addition foreign selling interest continued for a fourth consecutive month with an outflow with Rs. 9.7 billion for the week ending 9 November. The same trend was witnessed even in the secondary bill markets with April, August and September 2017 bills changing hands at highs of 9.65%, 10.12% and 10.20% respectively.

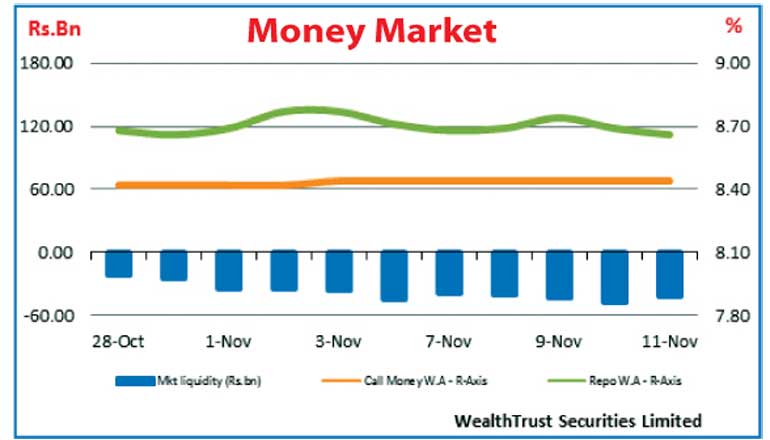

In money markets, the overnight call money and repo rates averaged at 8.44% and 8.69% respectively for the week as the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka continued to infuse liquidity by way of overnight Reverse repo auctions at weighted averages of 8.49% to 8.50%. The net liquidity shortfall stood at Rs. 42.15 billion for the week.

Rupee fluctuates

during the week

The USD/LKR rate on active one week forward contracts were seen appreciating leading to the US election to a level of Rs. 147.95/05 before dipping marginally once again on Friday to close the week mostly unchanged at Rs. 148.30/40. The daily USD/LKR average traded volume for the first four days of the week stood at $ 43.34 million.

Some of the forward dollar rates that prevailed in the market were one month – 148.95/05; three months – 150.65/75 and six months – 153.35/45.