Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 4 April 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

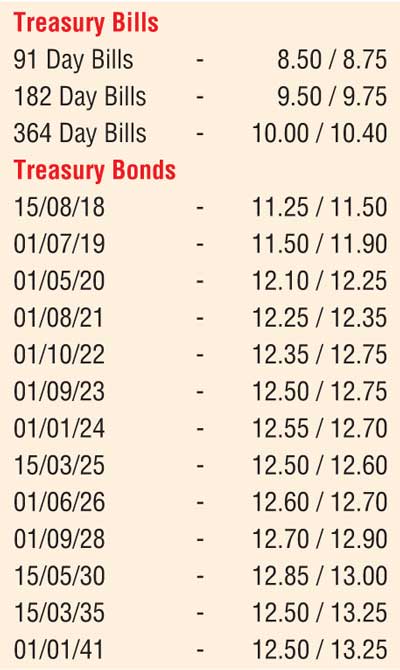

The secondary bond market witnessed substantial volatility during the week ending 1 April, as the first half of the week witnessed yields increasing on the back of the weighted averages recorded at the primary Treasury bond auctions and the weekly Treasury bill auction. However following the auctions at where demand was high, yields were seen decreasing towards the latter part of the week in secondary markets on the back of continued buying interest by foreign and local market participants. Activity centered on the liquid maturities of 01.05.20, 01.08.21, 01.09.23, 01.01.24, 15.03.25, 01.06.26, 01.09.28 and 15.05.30 with its yields decreasing to weekly lows of 11.95%, 12.15%, 12.60%, 12.60%, 12.55%, 12.55%, 12.75% and 12.80% respectively against its highs of 12.80%, 12.90%, 12.90%, 13.00%, 13.30%, 13.60%, 13.30% and 13.90%.

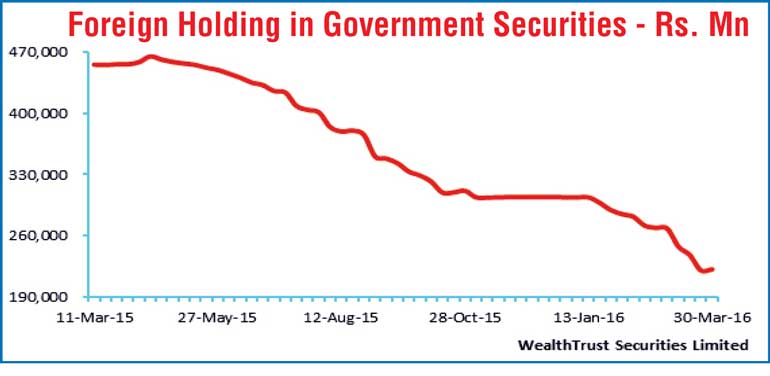

Meanwhile, the foreign holding in Rupee bonds was seen increasing for the first time in twelve weeks for the week ending 30 March, as an inflow of Rs. 1.19 billion was recorded.

In money markets, the overnight call money and repo rate increased marginally during the week ending 1 April, to average 8.06% and 8.01% respectively against its previous weeks averages of 7.95% and 7.96% as average liquidity in the market stood at a deficit of Rs.13.9 billion. The upward pressure in money market rates eased following the introduction of Reverse Repo auctions by the Open Market Operations (OMO) department of the Central Bank.

Rupee appreciates during the week

The expectation of dollar inflow saw the USD/LKR rate on the active spot next contract appreciating to a high of Rs.144.50 during the week against its opening low of Rs.149.30 and closed the week at Rs.146.30/50.

Some of the forward dollar rates that prevailed in the market were 1 Month - 147.00/40; 3 Months - 148.60/20 and 6 Months - 151.10/50.