Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 12 June 2017 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

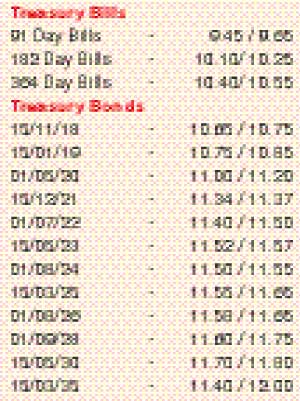

Sentiment in the secondary bond market turned positive towards the later part of the week, with yields declining on the back of fresh buying interest. A dip in the weighted average yields of all 3 maturities at the T Bill primary auction, with the 364 day bill moving down by an impressive 10 basis points, contributed towards this development.

The yields of the liquid maturities of 15.12.21, the two 2024’s (i.e. 01.01.24 and 01.08.24), 01.08.26 and 15.50.30 were seen declining to intra-week lows of 11.35%, 11.50%, 11.52%, 11.68% and 11.75% respectively, as against the pre-bill auction highs of 11.55%, 11.75% each, 11.79% and 11.95%. Furthermore, the 2018 maturities and 2019 maturities too were seen changing hands within the range of 10.35% to 10.70% and 10.85% to 11.04% respectively.

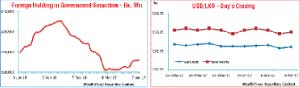

In addition, buying interest in the secondary bill market continued as well, with the 182 day and 364 day maturities attracting bids at levels of 10.25% and 10.55%, subsequent to the auction. This downward momentum was further supported by the increase in the foreign holding of rupee bonds by Rs.1.36 billion during week ending 07th June, reflecting a fifth consecutive week of inflows.

The daily secondary market Treasury bond transacted volumes for the first three days of the week averaged Rs.10.86 billion.

In money markets, net liquidity fluctuated during the week from a surplus of Rs.5.25 billion to a deficit of Rs.13.11 billion. However, the upward pressure in money market rates were controlled during the week with the Open Market Operations (OMO) Department of the Central Bank of Sri Lanka infusing liquidity by way of overnight reverse repo auctions, on days that the market showed a deficit. The overnight call money and repo rates averaged 8.75% and 8.85% respectively, during the week.

Rupee appreciates further during the week

The rupee on active spot next contracts closed the week marginally higher at Rs.152.83/88 against its previous weeks closing level of Rs.152.85/90, on the back of exporter conversions.

The daily USD/LKR average traded volume for the three days of the week stood at US $ 47.50 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 153.85/95; 3 Months - 155.95/05 and 6 Months - 158.85/95.