Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 5 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

Varying signals given to the market during the week ending 2 October, led to signs of the yield curve bunching up, with the short term yields moving up and the long term yields moving down.

This was despite declining inflation figures for the month of September, the positive outcome of the weekly Treasury bill auction where weighted averages were seen to remain steady and a narrowing of the gap between the primary and secondary market bond yields.

The most actively traded short term maturity of 01.04.2018 saw its yields increasing to weekly highs 9.45% as against the previous weeks closing levels of 8.70/90. This was closely followed by the 15 January 2017 maturity which increased to weekly highs of 8.20%.

However, on the longer end of the yield curve, the 1 August 2025 maturity was seen dipping to weekly lows of 10.35% against its previous weeks closing level of 10.40/50 while the 1 September 2023 maturity was seen changing hands at levels of 10.10% against its previous weeks closing levels of 10.10/20.

Meanwhile, in the secondary bill market, the 91 day bill was quoted at levels of 6.65/80.

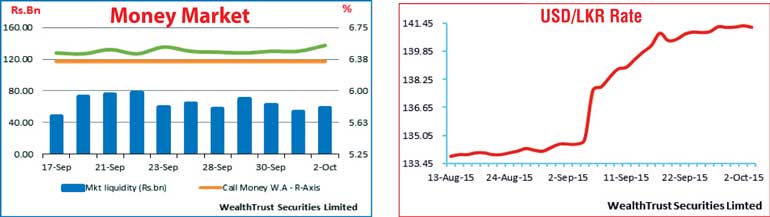

In the money market, overnight call money and repo rates remained mostly unchanged to average 6.35% and 6.48% respectively as average surplus liquidity in the system stood at Rs.60.79 billion.

Rupee losses ground during the week

The USD/LKR rate on spot contracts was seen depreciating during the week to close the week at 141.23/25 in comparison to its previous weeks closing levels of 140.98/00, on the back of continued importer demand. The daily average USD/LKR traded volumes for the first four days of the week stood at $ 88.03 million. Some of the forward dollar rates that prevailed in the market were one month – 141.84/00; three months – 143.10/30 and six months – 144.55/70.