Saturday Jan 11, 2025

Saturday Jan 11, 2025

Wednesday, 16 March 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

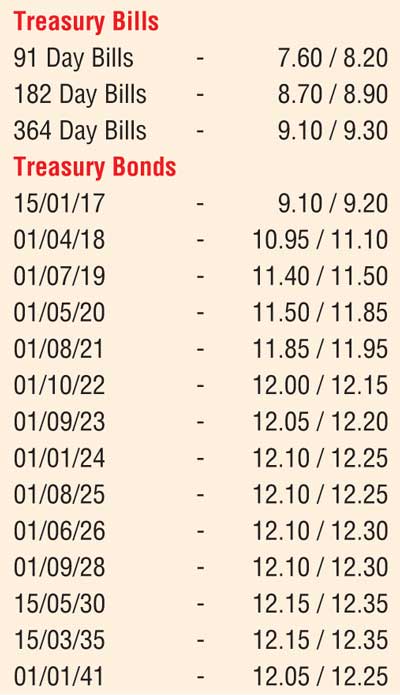

Activity in secondary bond markets remained rather dull yesterday ahead of today’s weekly Treasury bill auction.

A limited amount of activity was witnessed on the maturities of 15 August 2017, 1 July 2019 and 1 August 2021 within the range of 10.00% to 10.05%, 11.40% to 11.50% and 11.87% to 11.90% respectively.

Today’s auction will see a total amount of Rs. 22 billion on offer consisting of Rs. 5 billion on the 91 day, Rs. 8 billion on the 182 day and Rs. 9 billion on the 364 day maturities. At last week’s auction, all bids received were rejected for the second time over the past seven weeks.

Meanwhile in money markets, the overnight call money and repo rates dipped further to average 7.80% and 7.72% respectively as net surplus liquidity in the system stood at Rs.10.89 billion.

Rupee stable

In Forex markets, the USD/LKR rate on the active one week forward contract closed the day at Rs. 145.20/30 while spot contracts continued to be inactive. The total USD/LKR traded volume for 14 March was $ 47.25 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 145.95/20; three months – 147.40/60; six months – 149.60/90.