Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 13 June 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

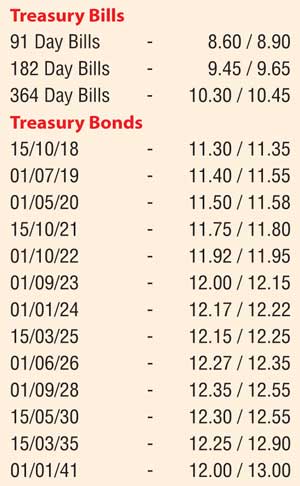

The IMF (International Monitory Fund) board level approval for a $ 1.50 billion EFF (Extended Fund Facility) to Sri Lanka coupled with a considerable dip in weighted averages at the Treasury bond auctions saw the secondary bond market close the week ending 10 June on a positive note. Activity increased during the week, centring on the liquid maturities of 01.05.20, 15.10.21, 01.01.24 and 01.06.26 as its yields were seen dipping to weekly lows of 11.49%, 11.75%, 12.10% and 12.25% respectively against its previous weeks closing levels of 11.65/80, 11.98/00, 12.37/42 and 12.43/48.

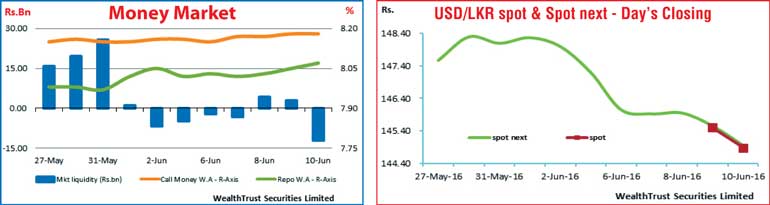

In addition, 2018 maturities and the 15.03.25 maturity were seen changing hands within the range of 11.18% to 11.30% and 12.18% to 12.23% respectively as the overall yield curve witnessed a parallel shift downwards week on week. Meanwhile in money markets, the weekly averages for overnight call money and repo rates increased marginally to 8.17% and 8.04% respectively as the net deficit in the market stood at Rs. 2.08 during the week ending 10 June against its previous week’s net surplus of Rs. 6.99 billion.

However the upward pressure was curtailed as the OMO (Open Market Operation) department of Central Bank injected funds throughout the week by way of reverse repo auctions at weighted averages of 7.99% to 8.00%.

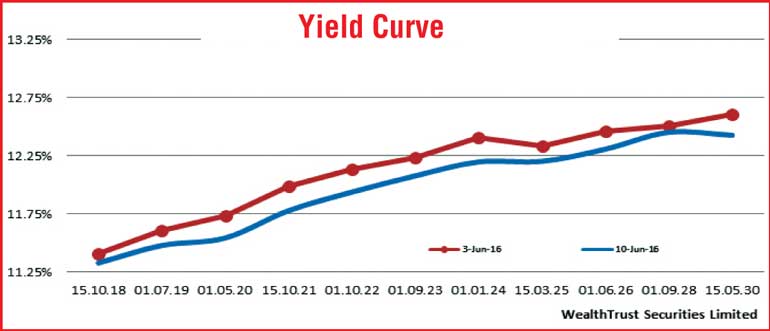

Rupee closes the week at a two month high

The confirmation of IMF’s EFF to Sri Lanka by its board saw the USD/LKR rate appreciate during the week. Spot contracts became active after a laps of two month to close the week at Rs. 144.75/00 while its spot next contract was seen appreciating to a two month high of Rs. 144.80/10 on the back of export conversions and dollar selling by banks. The daily USD/LKR average traded volume for the first four days of the week stood at $ 60.54 million.

Some of the forward dollar rates that prevailed in the market were one month – 145.50/75; three months – 147.20/50 and six months – 149.50/70.