Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 8 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The positive news of Japan and Sri Lanka upgrading their bilateral ties to a level of a “Comprehensive Partnership” ignited secondary bond markets yesterday as buying interest saw yields dip marginally.

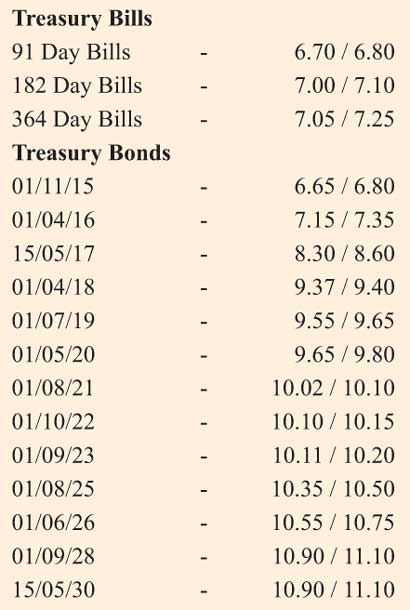

The liquid maturities of 1 April 2018, 1 July 2019, 1 May 2021, 1 August 2021 and 1 October 2022 saw its yields dip to intraday lows of 9.35%, 9.60%, 10.03%, 10.05% and 10.10% respectively in morning hours of trading subsequent to opening at highs of 9.38%, 9.65%, 10.08% each and 10.15%.

However, profit taking curtailed any further downward movement while the short tenure maturity of 15 July 2017 was seen changing hands within the range of 8.65% to 8.72%.

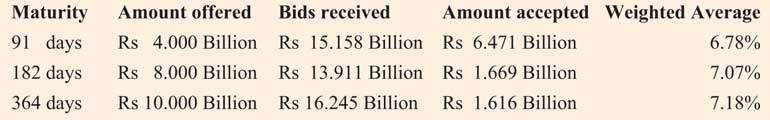

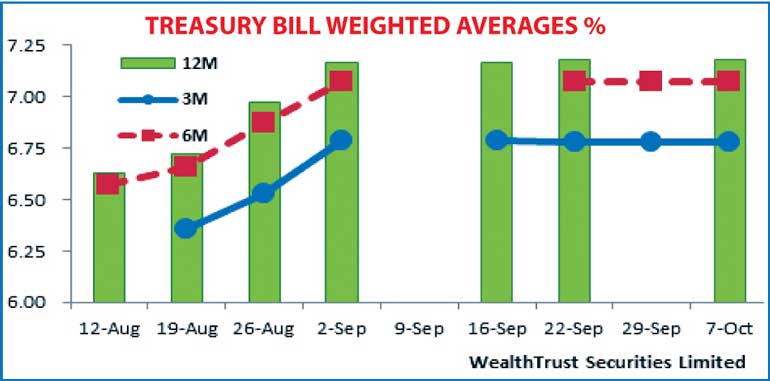

Furthermore, the outcome of the weekly Treasury bill auction endorsed this bullish sentiment further as weighted averages remained unchanged for a second consecutive week. The 91 day bill continued to dominate the auction as it represented 66% of the total accepted amount which was Rs 12.2 billion below the initial total offered amount of Rs 22 billion.

Meanwhile in money markets, overnight call money and repo rates remained mostly unchanged to average 6.36% and 6.48% respectively despite surplus liquidity dipping marginally Rs. 52.02 billion yesterday.

Rupee gains further

The rupee appreciated further yesterday to an intraday high of Rs.140.50 before closing marginally lower once again at Rs.140.62/66 against its previous day’s closing levels of Rs. 141.00/05 on back of the positive Japan/Sri Lanka news and export conversions continuing to outweigh importer demand. The total USD/LKR traded volume for 6 October was $ 50.50 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 141.20/30; three months – 142.45/60; six months – 144.00/15.